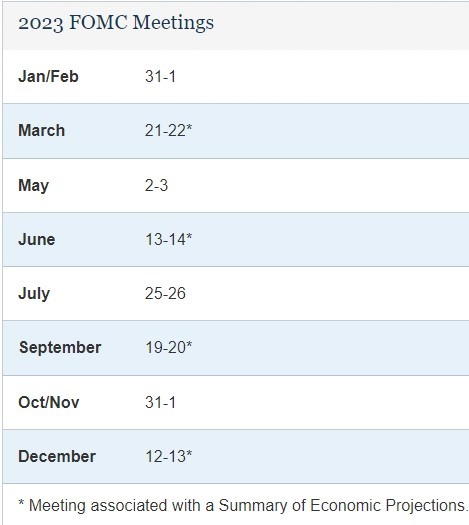

Goldman Sachs has abandoned its March Federal Open Market Committee (FOMC) rate hike forecast, now expects no hike at the 21/22 March meeting

- "In light of recent stress in the bankng system, we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March."

Goldman Sachs had been +25bp at the next four Federal Open Market Committee (FOMC) meetings.

Now:

- March on hold

- May +25bp

- June +25bp

- July +25bp

- terminal rate forecast 5.25 - 5.5%

---

The Goldman Sachs forecast stands in contrast to that from JP Morgan: