Federal Reserve Bank of New York President John Williams Q&A now.

Earlier:

In that post I mentioned that Williams did not drop any clue on whether her favours a +25 or +50bp rate hike at the next FOMC meeting. In the Q&A he still hasn't.

- Very important for public to understand Fed's desire to lower inflation

- Market pricing roughly consistent with Fed''s rate outlook

- Made sense for fed to slow rate rises in December

- Won't prejudge size of rate rise at upcoming FOMC meeting

- Fed still has a ways to go on rate rises

- Rate hike cycle stopping point depends on data

- Job market has been more resilient than expected

- Base case is that neutral rate stays low going forward

- Over longer run, inflation levels are determined by central banks

- Fed still faces challenges with core inflation readings

- There is still a lot of underlying demand for labor

- Inflation risks are still to the upside

- China's reopening will have a mixed impact on the global economy

- The end of lockdowns in China could tick global inflation higher

- addressing debt ceiling issues is the job of Congress

---

As head of the NY Fed Williams has a permanent vote on the Federal Open Market Committee (FOMC). He is also the Vice-Chair of the Committee (Powell chairs it).

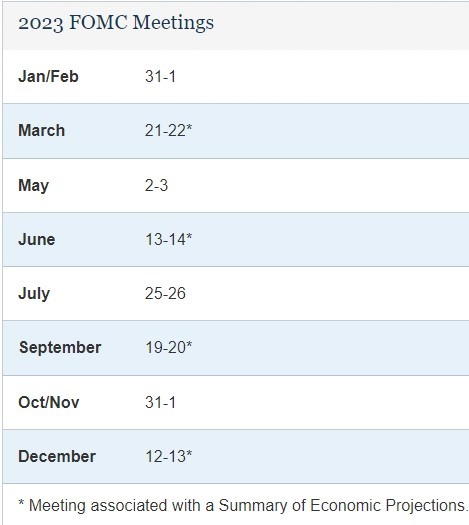

Meeting dates this year: