Nomura believes that the USD/JPY exchange rate may continue to strengthen in the short term, driven mainly by improvements in US economic data. However, as the JPY weakens, there is an increased likelihood of foreign exchange intervention or policy changes by the Bank of Japan, warranting cautious and agile strategies.

Key Points:

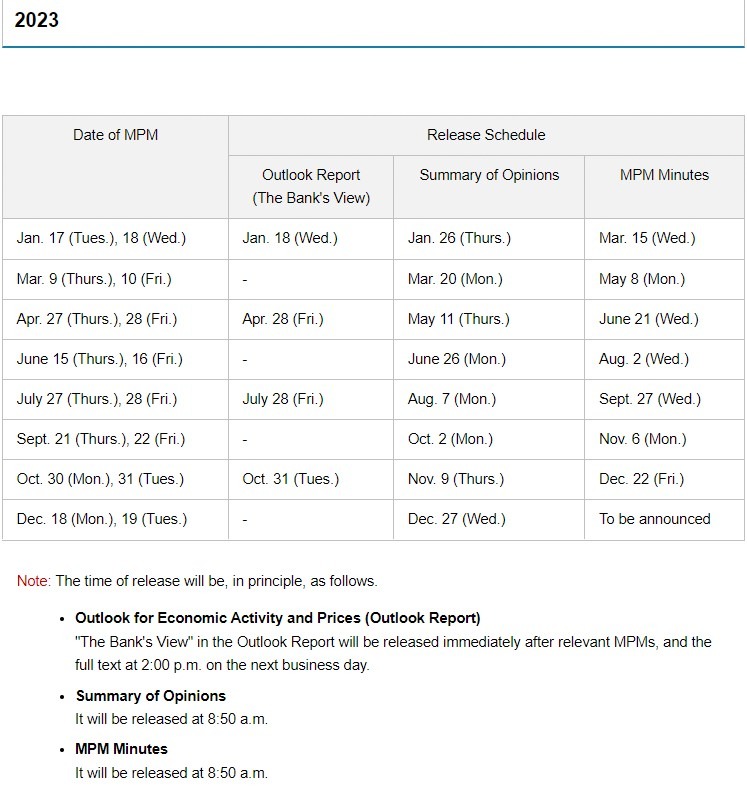

- USD/JPY Driven by US Data: Nomura observes that recent weakening of the Japanese Yen, coupled with improved US economic data, may contribute to the strengthening of the USD/JPY pair. An improving inflation trend may also sustain some expectations for policy changes leading up to the Bank of Japan's July meeting.

- Short-term Strengthening of USD/JPY: Nomura suggests that if positive surprises in US economic data continue, the USD/JPY is likely to strengthen gradually in the short term.

- Caution Due to Potential Intervention Risks: The financial institution highlights that as the JPY weakens, there is a heightened possibility of foreign exchange intervention or policy changes by the Bank of Japan. Nomura advises investors and traders to be nimble in response to these potential developments.

This is via the folks at eFX.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.

Gonna put my hand up and agree with Nomura on more USD/JPY strength to come still, and what to be wary of (obviously). ps. The next Bank of Japan meeting is not too far away, YCC tweak coming?