Fed chair Powell speaking

Fed chair Powell speaking at the Cato Inst. He says:

- we need to keep going until we get the job done on inflation

- very much my view we need to act 4th rightly, strongly on inflation

- my message is the Fed has and accepts responsibility for price stability

- longer inflation remains above target, greater the risks

- history cautions against prematurely loosening policy

- we are strongly committed to bring inflation down

- we will not be influenced by political considerations

- the Fed focuses on its mandate

- Publics expectations on inflation play an important role

- very important that inflation expectations remain anchored

- today they are well anchored over longer term

- at the short and the clock is ticking and more concerns public will incorporate higher inflation expectations

- we are committed to doing the job of making sure inflation expectations are anchored

- we hope to achieve a period of below trend growth

- labor is still very, very strong

- wages are running at elevated levels

- we think our policy moves will be will be able to put growth below trend and get labor market back into balance

- in the last labor market report, we saw welcome increase in labor force participation rate

- do not see the case for moving to a single mandate on inflation vs. maximum employment AND inflation

- we can achieve both goals in medium-term

- I would not want to see current mandate narrowed or broadened

- we have a precious grant of independence which allows us to pursue our goals without intervention

- Our current operation framework on balance sheet is a good one. No need to return to scarce reserves

- no decision made on central bank digital currency's

- digital currency's are speculative asset. It is not really a store value

- something that purports to be money ought to be regulated; we need legislation on this

- federal fiscal policy is not on a sustainable path

- we need to get inflation a job done now any keep at it

- we are always making monetary policy under high uncertainty; makes getting it right very important

As you would expect, Powell reiterates his commitment to inflation as expressed at the Jackson Hole symposium.

Stocks are moving lower ahead of the open and off of the comments from the Lagarde and Powell.

- S&P -21 points

- Dow industrial average -141 points

- NASDAQ index -89 point

The dollar is moving higher.

- The EURUSD has moved back below its 200 and 100 hour moving averages at 0.99718 and 0.99429 respectively, tilting the shorter-term bias back to the downside.

- The GBPUSD will back below its 100 hour moving average 1.15139. Bias back to the downside

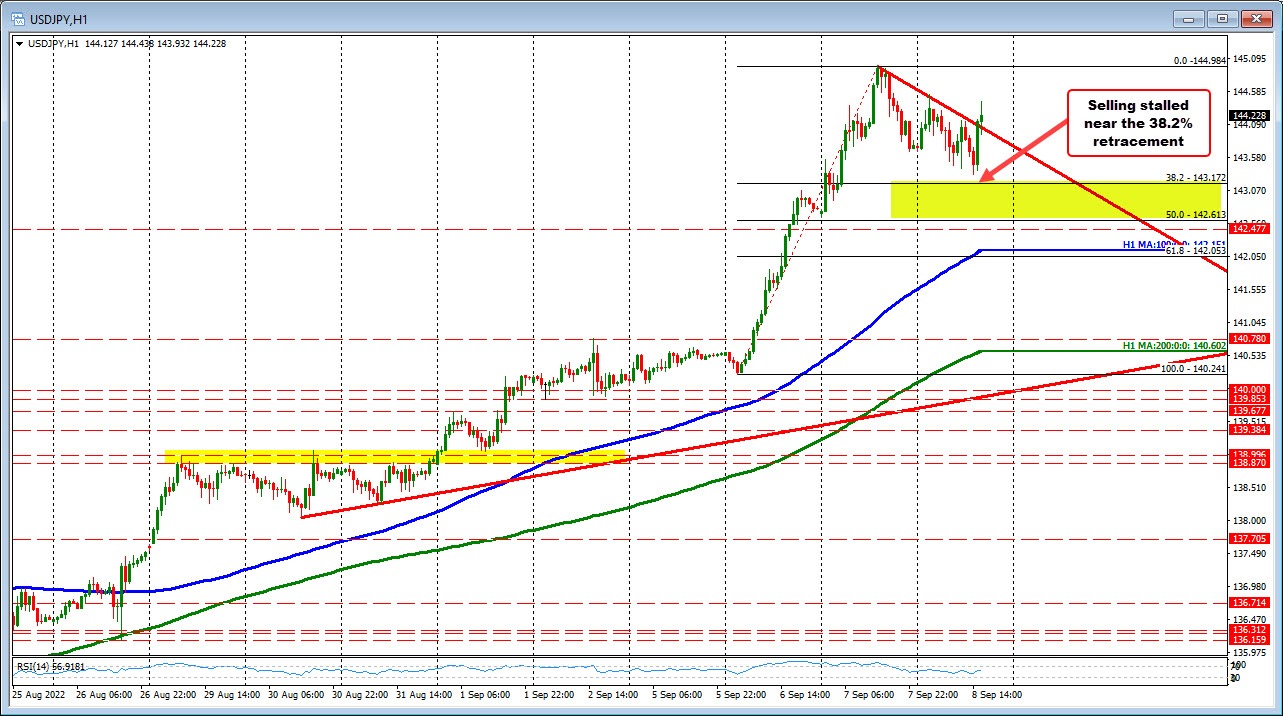

- The USDJPY is back higher on the day. The pair has been up 8 of the last 9 trading days.

The USDJPY is back above a topside trend line.