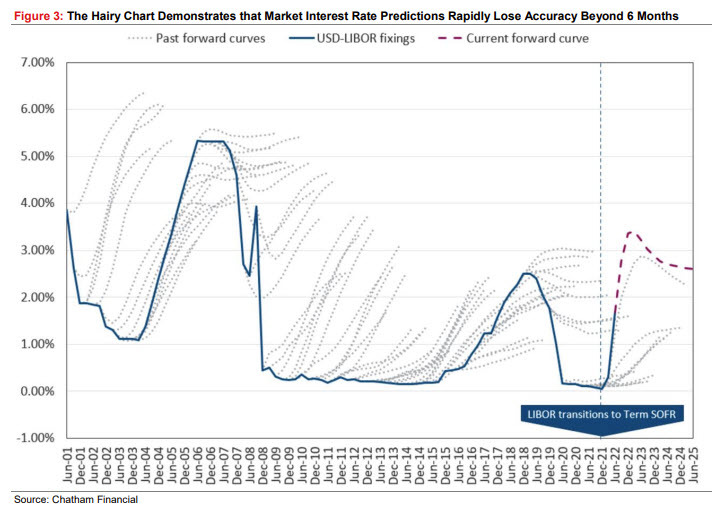

National Bank published this chart today, of which similar versions pop up periodically and they higlight that the market-implied path of rates rarely matches reality.

Looking ahead to 2023, they warn that the outlook is particularly murky, despite Fed protestations that it will hike and hold at high levels.

Given both the belated initial response to rising inflation in 2021 and the current course charted by the Fed, we lean more towards the possibility of a recession than a soft landing, likely followed by rapid rate cutting to breathe life back into a beleaguered economy. This outlook on rates and the likelihood of a recession appears to be in line with the consensus stance, but it is well-worth noting that the market's knack for forecasting rates does not typically extend beyond a six-month horizon before errors become significant. Longer-term forecasts are further complicated by two items that are rising in prominence on our shortlist of themes: U.S. elections (both midterms in November 2022 and the presidential election in 2024) and energy security, given continued geopolitical tensions and drastic pricing in Europe.

What leans against this is the Fed's lionization of Volcker and Powell trying to switch up his legacy from anything other than the guy who held rates too low and fuelled an inflation crisis.