TD "now expect the RBA to lift the cash rate 25bps at its next three meetings with a final 25bps hike in August, taking the terminal cash rate to 4.35%.

- Our prior 3.85% terminal rate call assumed 25bps hikes in March and May."

TD cite the strength of the NAB business survey (released yesterday) as their reasoning.

---

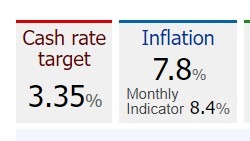

This from the front page of the RBA website shows the real cash rate in Australia is deeply negative. I'm surprised all analysts are not ramping their cash rate forecasts higher. Sure, the RBA expects the inflation rate to fall, but they see it only approaching the top end of the target band in 2025.

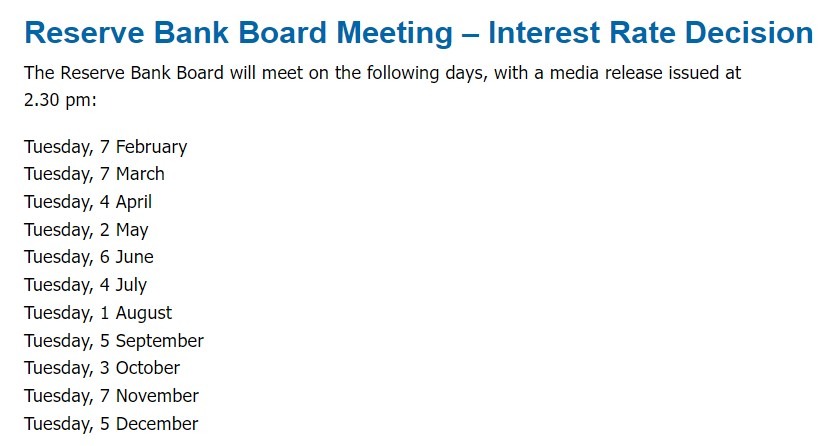

RBA dates for 2023. The TL;DR version of this is that the policy meeting is the first Tuesday of every month except January (holiday time).

Still to come from the Reserve Bank of Australia today: