The US dollar is under broad selling pressure after a pair of Fed speakers delivered broadly-similar comments that both highlighted the possibility of skipping a June hike and raising rates again in July, if necessary.

Holding US central bank policy rate constant at the current meeting should not be taken to mean rates have reached a peak for this tightening cycle, Jefferson said. That comment sounds like he's preparing the markets for just that, or at least the possibility of it it May non-farm payrolls soften and US May CPI isn't too high.

A short time later, Philly Fed President Patrick Harker said "I think we can take a bit of a skip for a meeting."

Both are centrist Fed members and this looks an awfully lot like coordinated communication. The Fed funds futures market is certainly seeing it that way with June hike odds crashing to 31% from as high as 70% after today's JOLTS data.

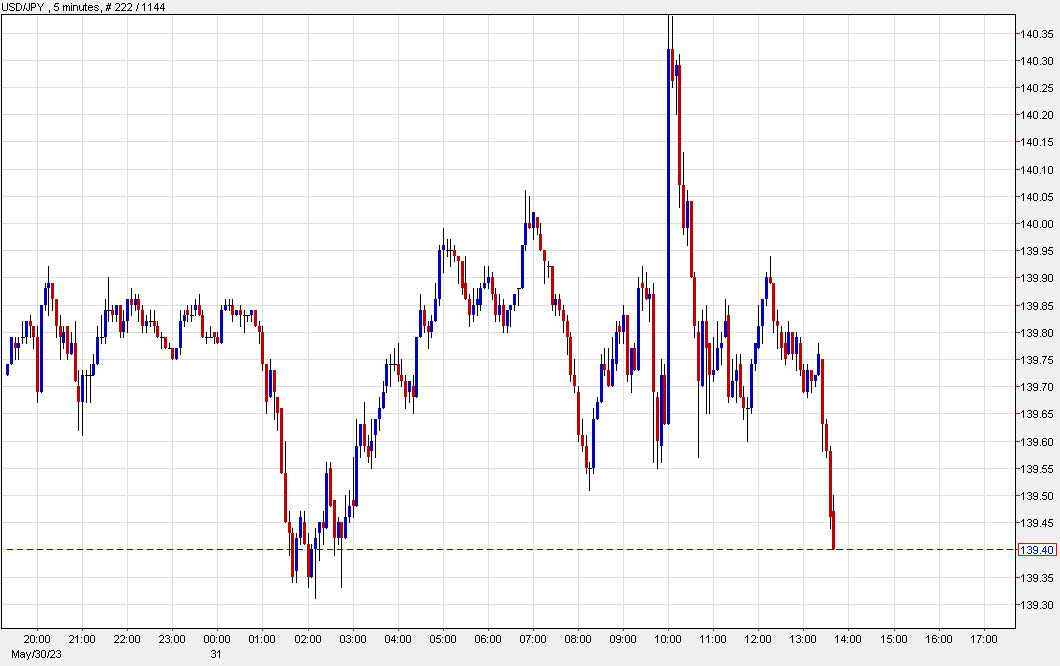

I have to imagine that Fed officials are hearing anecdotal reports of economic slowing. The US dollar is broadly weaker in the aftermath.