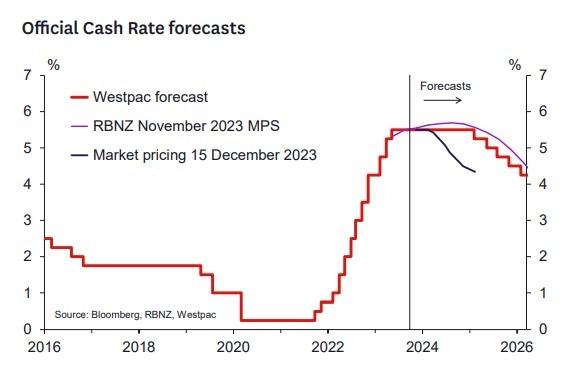

Via analysis from WPAC in New Zealand, their outlook for the Reserve Bank of New Zealand next year and into 205:

- We no longer expect the RBNZ to increase the OCR in 2024. Recent data highlights a noticeably weaker starting point for GDP and inflation which will likely see the RBNZ revert to their forecasts of August 2023. The RBNZ is likely to remain much more cautious than market pricing when considering OCR cuts.

In summary:

- The case for a hike in February now looks too thin.

- Recent GDP data shows a much weaker starting point for the economy.

- Headline inflation looks lower than previously forecast.

- OCR to stay at 5.5% through 2024 and gradual easing from early 2025.

On that second point above, revisions showed two consecutive quarters of negative growth in Q4 2022 and Q1 2023, the standard accepted definition of a recession.

Yesterday's data release:

***