A weekend piece in the Wall Street Journal (gated) from Fed insider Nick Timiraos.

Stubbornly high inflation is finally easing as supply chain disruptions fade and interest rates at 15-year highs put the brakes on demand. Now, Federal Reserve officials have voiced unease that prices could reaccelerate because labor markets are so tight.

At issue is what’s the right way to forecast inflation: a bottoms-up analysis of recent readings on prices and wages that puts more weight on pandemic-driven idiosyncrasies—or a traditional top-down analysis of how far the economy is operating above or below its normal capacity.

Some inside the Fed, including its influential staff, put more weight on the latter, which would argue for tighter policy for longer. Others prefer the former, which could argue for a milder approach.

---

The Federal Open Market Committee (FOMC) meet this week, statement is due Wednesday February 1 at 2pm US ET (1900 GMT) with Powell's presser following a half hour, later.

---

Some background to this.

- Back in June 2022 Timiraos dropped the bombshell during the Federal Reserve blackout period:

WSJ Fedwatcher Nick Timiraos is just out with a new report previewing the FOMC.

"A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate increase at their meeting this week," he writes.

The report is speculation but it taps into the old-style Fed leaks.

Timiraos was spot-on.

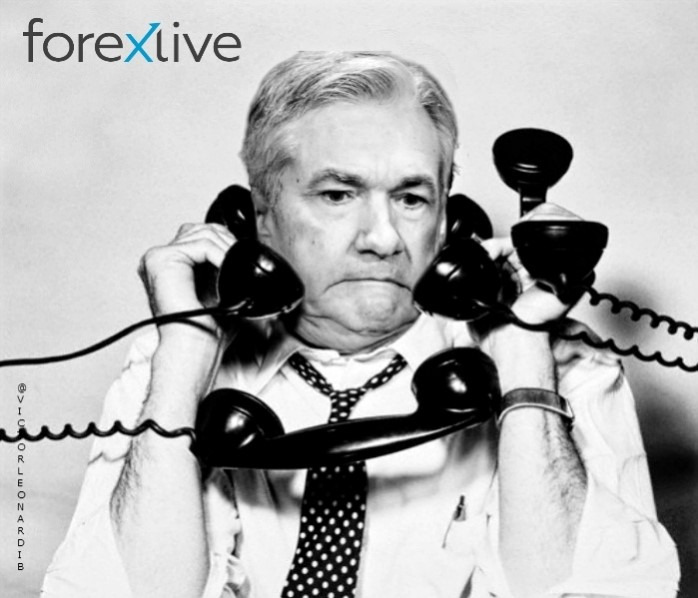

Timiraos has thus been crowned the new Hilsenrath (you may remember his role during the Bernanke Fed as a provider of Fed-insider info).

Timiraos on every line ....