Using May 1 is a great way to compare assets. Not only does it represent the start of a new month, it marked a turning point in markets as worries mounted about the global economy as US and Chinese growth slowed and it became clear that Europe’s LTRO was not going to solve the crisis.

Not surprisingly, JPY is the best performer but AUD is neck-and-neck with USD for second. Predictably, the euro is lagging.

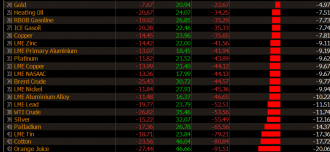

A look at commodities shows near-universal declines, save for food which is benefiting from the near-drought in the US and natural gas which has rebounded from long-term lows.

Singling out industrial metals, which are the best gauges of global growth, we see 7-17% declines since May 1. Crude is down 12%.

Major stock markets in the US, Japan and Europe are virtually flat over that period.

Given the nature of the period, the divergence between commodities, stocks and AUD is difficult to explain. Either stocks and AUD (not to mention bonds) are significantly overvalued or commodities are undervalued.

I tend to lean toward option 1. AUD has probably benefited from flows out of Europe and its new safe-haven status. Chinese rate cuts are emboldening longs but until commodities turn, there is no sign that they’re working.

Overall, AUD can continue to rally but from 1.0500-1.0850, the chance of a swift sell off makes it a dangerous trade. In the meantime, keep an eye on industrial metals prices.