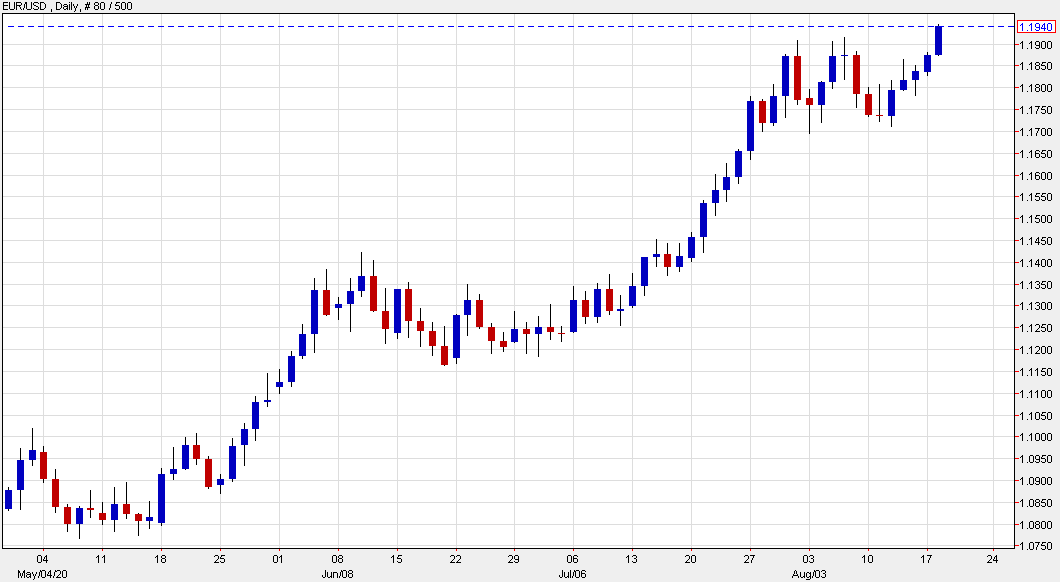

US dollar on the defensive again

The US dollar is sinking again.

The rundown of reasons to sell the dollar is this:

- US election/political risk

- Improving Republican polls increase risk of divided, deadlocked

- The lack of further stimulus could tee-up US economic underperformance

- Relative valuations are better outside the US (i.e. equity p/e ratios)

- Money is flowing out of USD safe-haven trades

- Debt monetization fears

At the moment, the euro and the pound are leading the way with the commodity currencies not far behind. It's a genuine dollar rout though and at some story the momentum simply takes over.

EUR/USD still faces a big level at 1.20 but it certainly looks like it can run. The major risk I continue to see is that equity markets begin to kick-and-scream about the lack of stimulus.