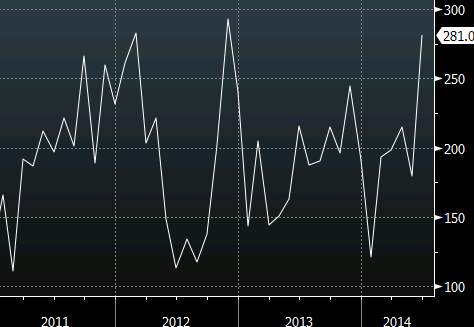

The ADP employment survey rose by 281K in June, far surpassing the 200K consensus.

ADP employment

The knee jerk reaction was to buy the US dollar but good news hasn’t been able to stick to the US dollar since the soft Q1 GDP revisions. The market has been focused on -2.9% Q1 GDP and unable to see better data on retail sales, consumer confidence, the services sector, manufacturing and housing. Perhaps a good jobs number will be the tipping point.

Some spots of US dollar weakness are understandable. The commodity bloc will benefit from a better economy in China while cable soars on rate hike talk. But the euro and yen are different.

The ECB has cut rates, may cut them again or start QE while they battle deflation and near-zero growth. Japan’s economy is feeling tax hikes and the yen is swamped by endless money printing.

The Fed has already looked past Q1 and if we see a few more good data points the hawks will begin to squawk about rate hikes. US dollar gains aren’t far away.