Today we will get a sneak preview of the GDP data (due June 6) with some key inputs to the data for release

At 0130GMT we get Australian data on

- Q1 company profits, expected +3.0%, prior +2.2% q/q

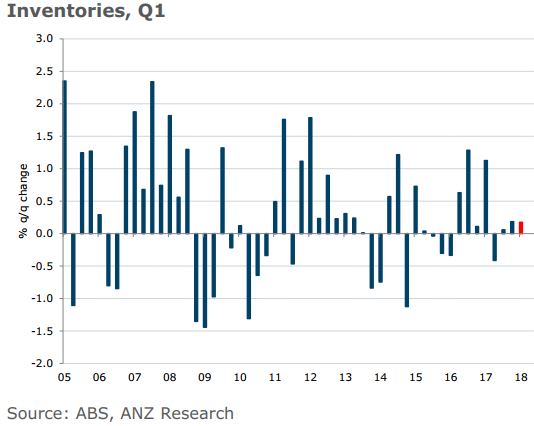

- Q1 inventories, expected 0.0%, prior +0.2% q/q

Previews of these via ANZ (bolding mine):

- Company profits look set to have risen a strong 3.3% q/q in Q1, building on the 2.2% rise in Q4. Commodity prices and volumes were stronger in the quarter, and we expect ongoing gains in non-mining profits given buoyant business conditions.

- We expect another 0.2% rise in inventories in Q1. This would see private non-farm inventories make zero contribution to GDP growth in the quarter. Measures of inventories are notoriously difficult to forecast, particularly volatile and subject to large revisions. They can often be key swing factors for GDP. Keep in mind that the volatile farm and public inventories numbers (not included in this release) can swing the National Accounts measure of total inventories around.

Preview of Inventories via Westpac (bolding mine), they are looking for a (small) negative input from these to GDP:

- Inventories, after a period of rebuilding in 2016, increased only modestly in 2017, up 0.5% (on an ex mining basis).

- In Q4, total inventories expanded by 0.2%, driven entirely by a jump in mining, while ex-mining declined by 0.2%.

- For Q1, we expect total inventories to edge lower, declining by 0.1% centred on a reversal in the mining sector. This would see inventories subtract 0.1ppts from activity in Q1.

- Recently, mining inventories have tended to alternate between a period of unintended build-up, due to temporary delays, (as in Q4) and a period of draw-down, to meet export shipments, (as in Q1).

- Non-mining inventories are expected to increase gradually to meet rising demand, up a forecast 0.2%qtr.

- As always with inventories, we note the elevated uncertainty.

---

ps. There will be more of these data points that will make up the GDP tomorrow

Q1 net exports

Q1 public demand