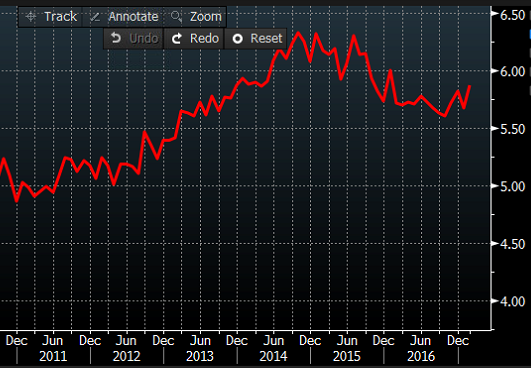

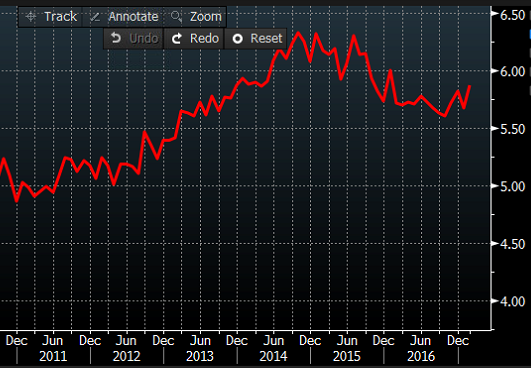

Australian February employment report, the 'employment change' is the headline figure, and the unemployment rate.

Employment Change: -6.4K ... A BIG MISS

- expected +16.0K, prior 13.7K

Unemployment Rate: 5.9% ... ditto - A BIG MISS

- expected 5.7%, prior 5.7%

- the rate is now at a 13-month high, having climber 0.3% in the past 4 months

- let me just slip this in (Bloomberg graph of unemployment rate - sa):

Full Time Employment Change: +27.1K

- prior was -44.5K

Part Time Employment Change: -33.5K

- prior was +58.2K

Participation Rate, 64.6%

- expected is 64.6%, prior was 64.6%

The above data is the 'seasonally adjusted data - and that's the market focus. The Australian Bureau of Statistics tell us to look at the 'trend' data (sort of like sticking your feet in a bucket of ice and your head in a hot oven, on average you're doin' just fine!).

But, here's how the ABS phrase it: Trend series smooth the more volatile seasonally adjusted estimates and provide the best measure of the underlying behaviour of the labour market.

OK then ... here it is:

TREND data:

- trend unemployment rate 5.8 per cent

- The quarterly trend underemployment rate remained at 8.6 per cent

- "The underemployment rate is still at a historically high level for Australia, but has been relatively unchanged over the past two years" - comment from Australian Bureau of Statistics

- Trend employment increased by 11,600 persons

- An increase in both full-time (4,600) and part-time (6,900) employment

- This was the fifth straight month of increasing full-time employment, after eight consecutive decreases earlier in 2016

- Total employment growth over the year was 0.8 per cent, which was less than half the average growth rate over the past 20 years (1.8 per cent)

- The trend monthly hours worked increased by 1.2 million hours (0.1 per cent), with increases in total hours worked by both full-time workers and part-time workers

- The trend participation rate was unchanged at 64.6 per cent

AUD has barely moved: