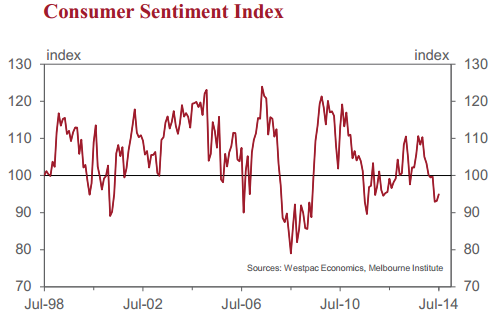

Westpac Consumer Confidence Index (s.a.) for July +1.9% m/m to 94.9

- prior was +0.2% to 93.2

- A record 74% of those surveyed recalled unfavourable news on the budget and taxes

- Confidence in the labour market remains “stubbornly” weak

- Bill Evans, Westpac chief economist, still expects a ‘solid’ confidence recovery over 2014

More from Westpac:

- This is another disappointing result for the Index.

- We had expected a stronger bounce back in the Index following its 7% tumble in the aftermath of the Commonwealth Budget in May.

- The Index is now only 2% above that recent low in May. It is also 14% below the recent high in November 2013 and 10% below the average print in 2013.

- The Reserve Bank board meets on August 5. Barring any unexpected economic shocks the Board is certain to hold rates steady.

- However, markets have responded to the weak run in data and confidence by now pricing in a 50% probability of a rate cut by early next year. That stands in contrast with our own forecast of a rate hike by the September quarter next year.

- Clearly the issue for rates will be the prospects for the consumer over the course of 2014. Ongoing weakness in the consumer is likely to see businesses scaling back investment and employment plans. Equally, a resumption of the solid trends in consumer spending that we saw through the second half of 2013 and into 2014 will boost investment and employment plans from business.The slowdown in retail sales and housing markets suggests the recent weakness in the sentiment is already affecting activity to some extent.

- In this note we have indicated an expectation that confidence will recover through 2014 as anxieties around the Budget ease. In time, those trends, along with a gradually improving global economy will lay the foundation for higher rates later in 2015. Westpac expects rates to remain on hold for the next year or so prior to a first hike in August next year.

–