There is plenty on the economic data agenda today, the BOJ and China PMIs the big focus

But, from Australia there is building permits data due at 0130GMT

Preview posted yesterday (what ANZ is expecting):

This now via Westpac:

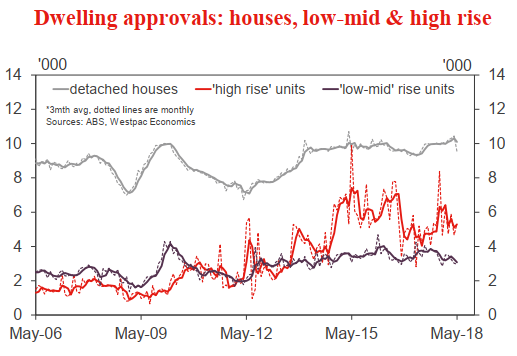

- Dwelling approvals fell 3.2% in May with a surprisingly sharp 8.6% fall in private detached houses partially offset by a 4.3% rise in units. With some wild swings in some of the state detail, we advise caution in interpreting the latest figures. In particular, a sharp fall in Qld may prove to be noise or a temporary pull-back. More generally, key parts of Westpac's forecast for a further weakening in high rise construction have yet to come through.

- The June update should resolve some of these questions. While the May drop looks overdone, construction-related housing finance approvals continue to point to a clear downtrend in non-high rise approvals. Meanwhile site purchases have for some time been pointing to a further sharp leg lower for high rise approvals. On balance we expect total approvals to hold flat in June even with some give back on the May weakness in houses. Risks abound including potential upward revisions to previous estimates.

----

ICYMI (this is going to be a busy session):

- Goldman Sachs preview possible options for the BOJ today, and the impact on yen

- Here is how the BOJ could change policy (while sneakily announcing no change in policy)

- What to expect from USD/JPY after the BOJ meeting this week

- What time to expect the Bank of Japan announcement today, preview & yen impact

- When is the BOJ meeting this week and what time we can expect the announcement