We got RBA policy meeting minutes earlier, where slow wage growth was again mentioned:

- Wages expected to pick up gradually as leading indicators pointed to more job gains

- Still uncertainties remain on extent, speed of pick-up in wages and inflation

More here: RBA minutes: More likely next cash rate move is up rather than down

Tomorrow, Wednesday 15 May 2018 Australian time, due at 0130GMT

Preview, via Westpac:

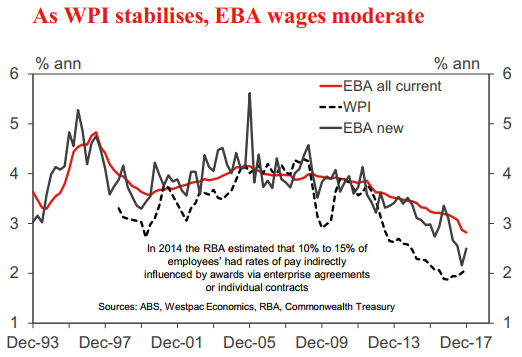

- There has been some tightening in the Australian labour market, as measured by the broader measures of labour utilisation, but we still observe ongoing weakness in wage outcomes. Total hourly wages ex bonuses increased 0.6% in the December quarter, just slightly above market and Westpac expectations for 0.5% lifting the annual pace modestly from 2.0%yr to 2.1%yr.

- Private sector wages grew 0.5% holding the annual rate at 1.9%yr. Public sector wages grew 0.6% with the boost coming from professional & technical (1.0%), education (0.8%) and health care (0.9%). Public sector wage inflation is holding an annual pace of 2.4%yr which is just up on the 2016 record low of 2.3%yr.

- The December quarter reported a modest uptick in new Enterprise Bargaining Agreements wage outcomes, but they are still less than the average of existing agreements.