A snippet from Barclays' FX & EM Macro Strategy FX Views for the Year

We continue to see the USD moving lower over the medium-term given existing USD overvaluation and narrowing cyclical differences as global growth becomes more synchronized.

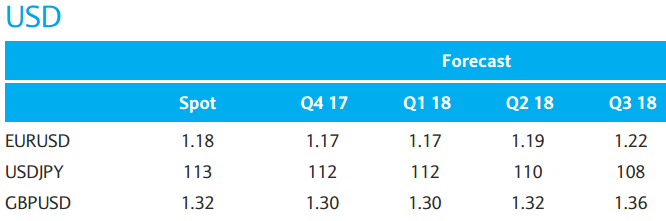

- Our forecasts point to a gradual downtrend in the USD NEER of roughly 4% through end 2018 with the larger declines vs. European FX, JPY and EM Asia.

- In the near term, however, we forecast some support for the USD into early 2018, particularly given the market focus on the prospects for any upward surprises from US tax policy announcements through Q4 and into Q1 (when we expect its potential passage).

The package of modest tax cuts, which appears much more likely, may present some upside risks to our range-bound USD forecast into Q1 18, but we believe it is unlikely to challenge the highs seen at the beginning of 2017 or change the downtrend for the USD.

The market continues to price in fewer hikes relative to Fed dots or our own forecasts.

- The risks of an exogenous shift towards hawkish policy have dissipated under the new Fed chair nominee, Jerome Powell. However, four additional appointees to the Fed board in coming months, along with the vacancy at the NY Fed, may change the FOMC's make-up. Even if changes at the Fed lead to a faster pace of rate hikes, we believe this is not likely to change the terminal rate in the current cycle and as such will aid further flattening in the US yield curve.