BlackRock is the world's largest asset manager (circa $7.4 trillion in assets under management. last time I looked).

The firm says it has downgraded nominal U.S. Treasuries and upgrading their inflation-linked peers. Citing:

- Markets are increasingly reflecting a unified Democratic government outcome that may lead to a significant fiscal expansion. This electoral outcome would bring forward the market pricing of the higher inflation regime that we were already reflecting in our strategic asset views.

Long story even shorter is fiscal expansion under Dem sweep would lead to higher UST yields, lower prices.

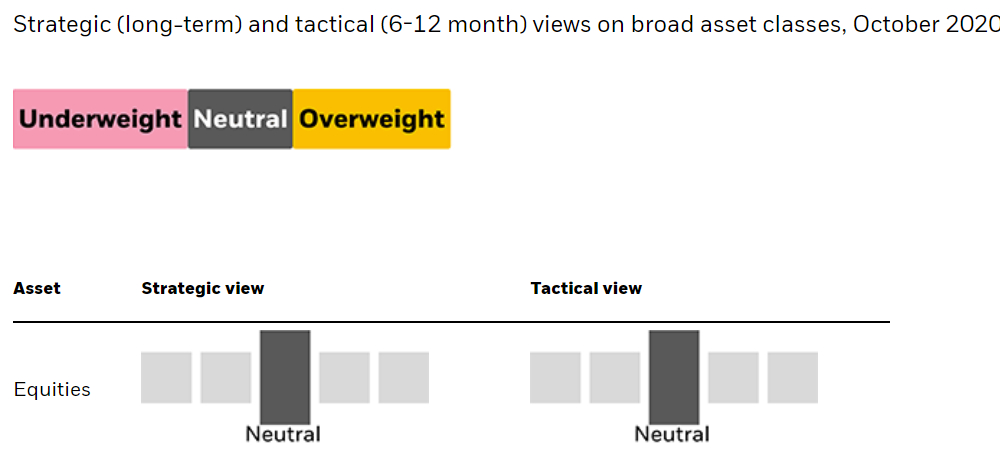

As a ps. the outlook for equities is neutral: