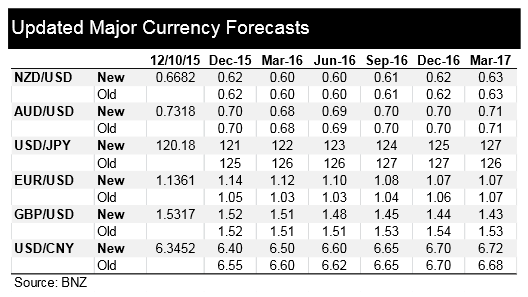

BNZ have updated their forecasts for EUR, GBP, JPY, and CNY

- Adjusted to account for a less aggressive USD rise through 2016

- NZD and AUD forecasts are unchanged, largely in anticipation of heightened market volatility ahead

There is a lot more on this from BNZ, but in brief:

- Since the Fed's decision to stand pat on rates at its September policy meeting, investors have swung between fearing for global growth, and cheering for lower-for-longer interest rates

- There is a great deal more uncertainty about the near-term direction for currencies than there was just a few months ago, in part thanks to these large and unpredictable swings in sentiment

- We have left our NZD and AUD forecasts unchanged, wary of spikes in market volatility that would see these risk - sensitive currencies correct sharply

- Indeed, if anything is clear about market trends today, it is that risk assets (equities, commodities, emerging market currencies) have become much more correlated than in the past two years