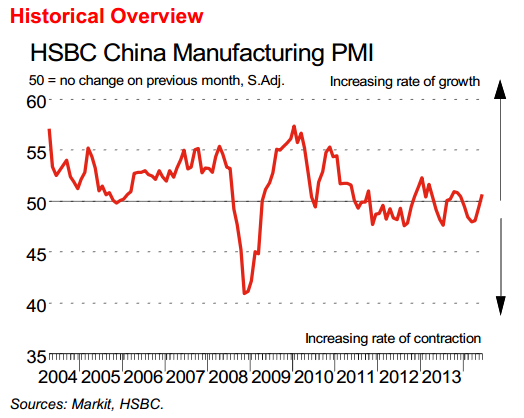

China HSBC/Markit Manufacturing PMI for June,

- expected 50.8, prior was 49.4, flash reading for June was 50.8

Key points:

- Output rises for the first time since January

- Stocks of finished goods decline at strongest rate since September 2011

- Rate of job shedding eases

Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC said:

- “The HSBC China Manufacturing PMI final reading for June rebounded to 50.7, up from 49.4 in May, and relatively unchanged from the flash reading.

- This confirms the trend of stronger demand and faster destocking.

- The economy continues to show more signs of recovery, and this momentum will likely continue over the next few months, supported by stronger infrastructure investments.

- However there are still downside risks from a slowdown in the property market, which will continue to put pressure on growth in the second half of the year.

- We expect both fiscal and monetary policy to remain accommodative until the recovery is sustained.”

-

More:

- New orders at strongest in 15 months

AUD/USD has done little on the release, just of the session lows and in the middle of the morning’s range. We’re awaiting the RBA announcement at 0430GMT