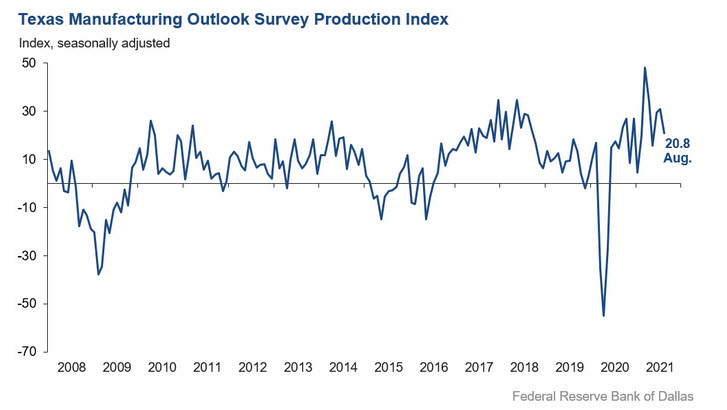

Dallas-area manufacturing survey for August 2021

- Prior was 27.3

- Production index at 20.8 vs 31.0 prior

- New orders 15.6 vs 26.8 prior

- Prices paid 74.9 vs 73.5 prior

- Wages and benefits 43.4 vs 46.0 prior

- Future index 11.5 vs 22.2 prior

This is a lower-tier manufacturing index but there are some concerning trends here, particularly in new orders. That may simply reflect the recent weakness in oil but it's something to watch.

Selected comments:

- We are having increased difficulty in procurement of raw materials and logistical costs.

- Business is still good. Our problems are not orders-we have plenty-but we don't have enough people or raw materials to fill all orders.

- We have had unprecedented increases in steel raw materials and are unable to secure long-term commitments for volume or price.

- In terms of our pipeline of contract opportunities, demand at market level is decreasing for new construction, but maintenance deferred from last year's COVID interruption is filling the void for now.

- Shortages and pricing of American iron and steel products are delaying projects and availability of our emergency fittings. Some domestic stainless steel material pricing is now 14-28 times the price of imported material and not available for 12-16 weeks.

- This is the worst market I have seen since 1975 -- Machinery Manufacturing

- We see variations in sales from month to month that are hard to explain. Sales are up one month and then down the next. We would prefer a steady flow of business so that we can plan accordingly. Strange times we live in!

- We are having issues getting parts in to make and complete orders on hand

- Labor costs continue to rise, and supply-chain disruptions with major material components continue to drive production delays, increased costs and uncertainty.

- It is impossible to find employees. We are having to work the ones we have way too hard.

- Team members out with COVID is causing disruptions.