From George Saravelos, Strategist at Deutsche Bank

We have been structurally bearish EUR/USD for a long time but scaled back our confidence levels this year as the Fed turned dovish and the ECB ran out of easing options. The Trump victory has changed things.

We now feel more confident that EUR/USD will break out of its 1.05-1.15 range and trade through parity next year.

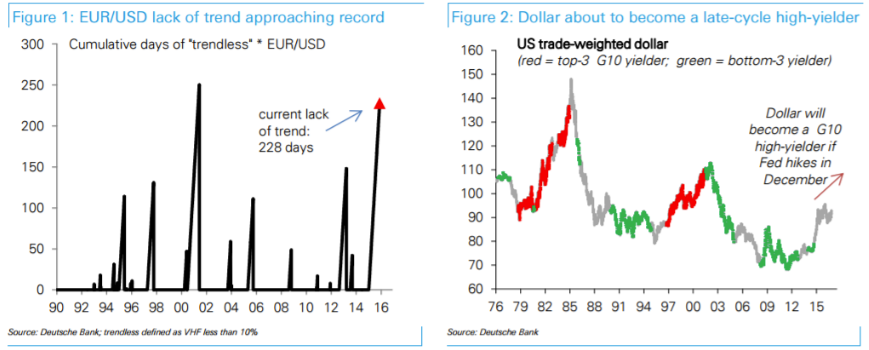

First, it is high time EURUSD started to move again. The duration of the current lack of trend is approaching a record high (chart 1). When EURUSD last broke out of such a prolonged range corporate hedgers and asset allocators were caught off guard and the EUR moved 10% within the following few weeks.

Second, the dollar is approaching its sweet spot for a late-cycle rally. Big dollar moves are less dependent on the change in short-end yields but on the absolute level: whenever the dollar becomes a top-3 G10 high-yielder it rallies as yieldseeking inflows return. A Fed rate hike this December will make the dollar the third highest yielding currency in the world, a strong dollar positive (chart 2).

Finally, divergence is back. Even before Trump, the risks to US growth were tilted to the upside (chart 3). More fiscal and regulatory easing would add further upside risk to the growth and Fed outlook. Meantime European risks are tilted to the downside given a deteriorating credit impulse and political outlook (chart 4). The recent rise in European real rates increases the odds of a more dovish ECB.

Our EUR/USD forecasts remain at 1.05 and 95 cents for end-16 and end-17 respectively.

-