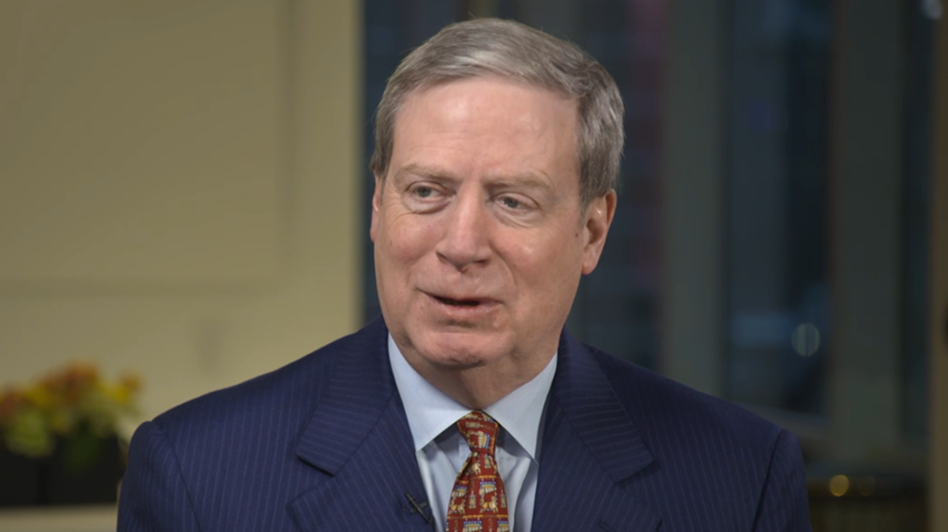

Comments on CNBC from the legendary investor

- I'm not looking for the dollar to crash or anything

- The FX market tends to move slowly

- Covid is the most unique economic period I've ever lived through or studied

- Deficit increased during covid more than last 5 recessions combined

- The Fed mirrors similar extreme measures

- Fed bought more Treasuries in six weeks than all of Bernanke/Yellen combined

- The Fed has been monetizing the debt

- All the money coming into the US into bonds and equities over last 10 years will be slowly seeping out

- There's a high probability of inflation in 5-6 years, starting in about a year

- I own a tiny bit of Bitcoin but I own a lot more gold

- Likes Rio Tinto, BHP, Freeport-McMoran

- Says pull-forward could hurt home reno stocks and things like Clorox

- You can see the light at the end of the tunnel

Legendary investor Stanley Druckenmiller has been saying much of the same for awhile. It's a good interview though, if you can track it down, particularly the parts where he talks about foreigners slowly exiting Treasuries and US stocks to put pressure on the dollar.