Final services, composite PMI data for October offer some distraction

And so the wait begins.

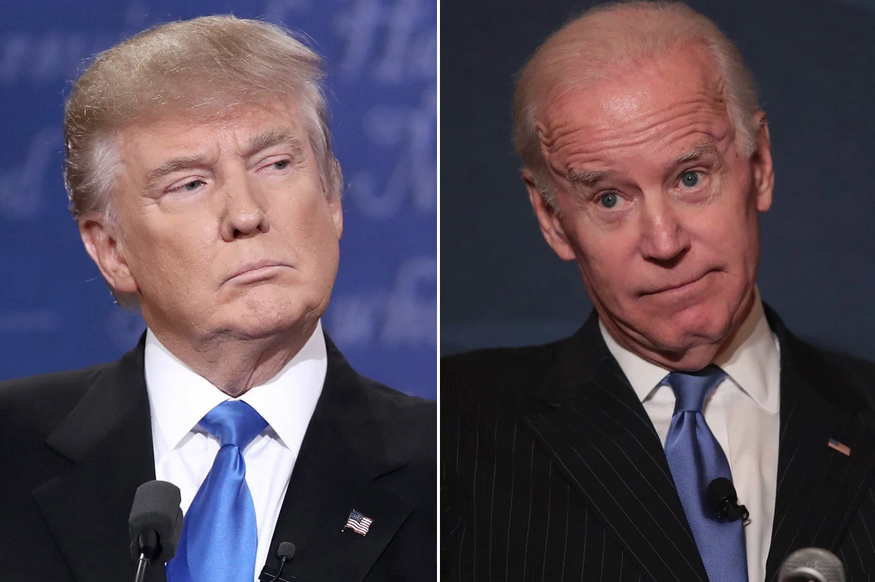

It is unlikely we'll see a winner declared tonight in the US presidential election, with the likes of Pennsylvania, Michigan and Wisconsin seeing the count delayed.

Stock futures may have rallied but they may not quite like the uncertainty associated with such a scenario for long i.e. being kept in limbo.

That is the key risk to be mindful of in the session ahead, though we may only get a better feel of the action once Wall Street gets up and running again in the day ahead.

In Europe today, the market will be more heavily tuned in on the election and assessing what the possible results may mean. For now, the dollar is taking it all in stride and keeping modest gains following the beat down yesterday.

I'd argue that only a Trump victory will be able to keep the dollar in good stead in terms of a reaction to the election but even so, the bigger play in my book is to fade those gains unless stocks/risk fail to perk up amid any stimulus setback.

0815 GMT - Spain October services, composite PMI

0845 GMT - Italy October services, composite PMI

0850 GMT - France October final services, composite PMI

0855 GMT - Germany October final services, composite PMI

0900 GMT - Eurozone October final services, composite PMI

The focus is on the final readings from France, Germany and overall Eurozone. They are expected to reaffirm a two-paced economy towards the year-end with November set to see more dour figures amid tighter restrictions limiting economic activity.

0930 GMT - UK October final services, composite PMI

The preliminary release can be found here. The final readings here should reaffirm that the UK economy has lost some steam going into Q4 and with lockdown measures underway, the outlook for the remainder of the quarter looks bleak. But that sentiment has already been factored in since the weekend, or at least kept in view in light of the focus on the US election at the moment.

1000 GMT - Eurozone September PPI figures

Prior release can be found here. A lagging and proxy indicator of inflation pressures, not a major release by any means.

1200 GMT - US MBA mortgage applications w.e. 30 October

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week. The focus will once again be on purchases as that has been one of the more bullish spots outlining that US economic conditions are not as dire as first suggested by the recent dip due to the coronavirus impact.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.