UK and Eurozone inflation in focus today

There's no stopping the dollar as we see EUR/USD break down to fresh lows below 1.1300 and USD/JPY climbing to its highest levels since March 2017 nearing 115.00.

The technical tailwind continues to stay the course for the greenback and there isn't much on the agenda to change the current besides Fedspeak this week.

Treasury yields also continue to tick higher, with 10-year yields rising to 1.64% overnight so that is providing some added impetus for USD/JPY on the way up.

Elsewhere, equities are doing their own thing though with US indices nearing all-time highs once again. Futures are more tepid today but that seems to be the trend in Europe before things pick up during US trading later.

UK and Eurozone inflation data will be ones to take note of in the session ahead with the former one to watch as a higher reading will just reaffirm BOE rate hike expectations going into the December meeting.

0700 GMT - UK October CPI figures

Prior release can be found here. UK annual inflation is expected to tick higher once again, inching closer towards 4% and that will exert more pressure on the BOE to hike rates in December after all the talk they have been doing. The pound may get a light jolt on any strong readings but gains are likely to be more evident in EUR/GBP rather than GBP/USD as the dollar runs rampant since last week.

1000 GMT - Eurozone September construction output

Prior release can be found here. A lagging data point but one that is likely to reaffirm sluggishness amid supply and capacity constraints going into Q4.

1000 GMT - Eurozone October final CPI figures

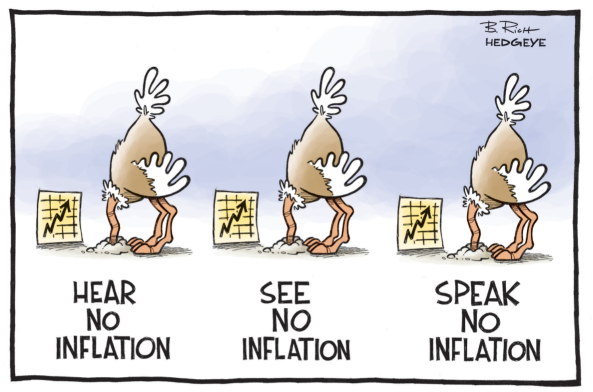

The preliminary release can be found here. The final readings should reaffirm inflation at a 13-year high and despite the ECB maintaining all of this is transitory, it will be tough to keep fighting the numbers as they surge higher in the months ahead.

1200 GMT - US MBA mortgage applications w.e. 12 November

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.