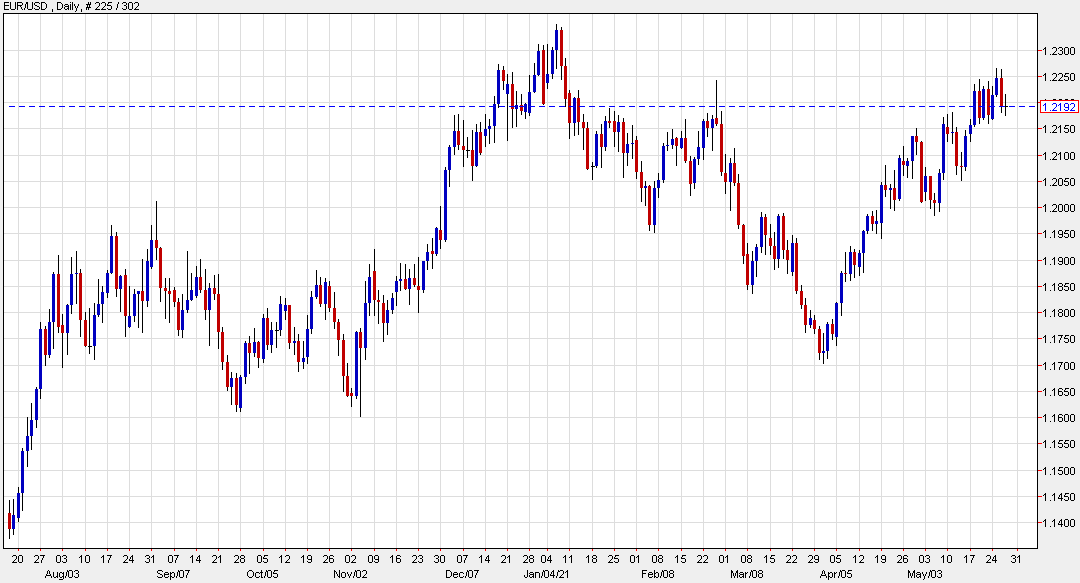

EUR/USD is flat at 1.2192 today

Credit Suisse discusses EUR/USD outlook ahead of the ECB June 10 meeting.

"The risk the ECB faces is that, if it takes its eye off the ball as the Fed retains its dovish bias, EURUSD could take out 2021 highs around 1.2350 and push higher into an entirely new, and possibly very uncomfortable, trading range. It's true that rising euro area inflation expectations and growth prospects likely make the ECB comfortable with EURUSD levels at the top end of the 1.0340 - 1.2555 range that has prevailed since the start of 2015. But we are less confident it would be excited about seeing EURUSD move back towards the average level near 1.3500," CS notes,

"It is for this reason that, while we have assumed that EURUSD will likely test the top of our expected 1.1950-1.2350 range for the rest of Q2 ahead of the 10 Jun ECB meeting, we have held the view that the ECB will contrive to sound just dovish enough to prevent a material and sustained upside breach," CS adds.

For bank trade ideas, check out eFX Plus.