Italy FTSE MIB bucks the positive trend though

The European stock market is ending the session with some stong gains:

- German Dax is up 1.3%

- France's Cac is up 0.9%

- UK FTSE is up 0.9%

- Spain's Ibex is up 0.5%

- Portugal's PSI20 is up 0.5%

- Italy's FTSE MIB fell 0.1%

In the 10 year note sector yields are unchanged to mostly higher.

- Germany 0.399%, unchanged

- France 0.70%, unchanged

- UK 1.086%, up 1.6 bp

- Italy 2.10%, up 6.7 bp

- Spain 1.567%, up 2 bp

- Portugal 2.772%, up 2.5 bp

- Greece, 5.566% -5.4 bp

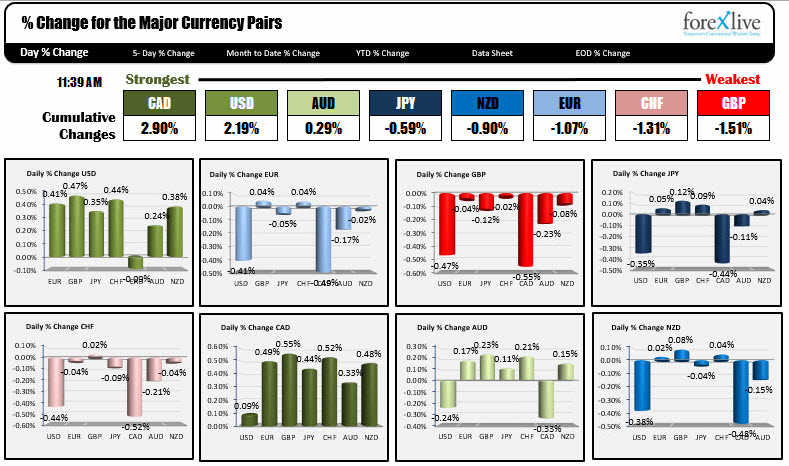

At the NY midday, the CAD is the now the strongest currency. The retail sales ex auto were much better than expectations and led to a run up in the CAD. The USD has relinquished it's spot as the strongest currency for the day. The greenback could not extend gains and we are seeing some covering.

The GBP is the weakest currency today but it is seeing a rebound from lows after failing to push through lows from June and the earlier low from today (see post here).

US stocks are rising nicely. The Nasdaq is back above its 50 day MA at 6272. It trades at 6282 up 1.11%. The S&P is up 18.6 points or 0.77%. The Dow isup 154 points or 0.71%.

US yields are up 1 to 2 bps.

- 2 year up 1.6 bp

- 5 year up 2.1 bp

- 10 year up 1.7 bp

- 30 year up 1 bp