Latest data released by Eurostat - 14 March 2018

- Prior m/m +0.4%

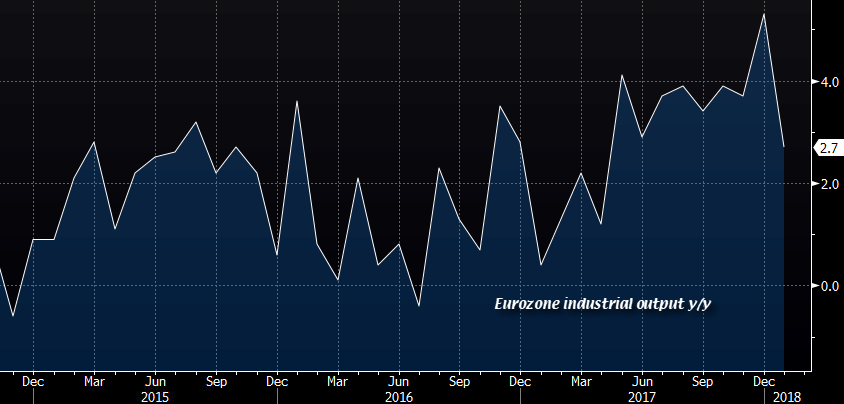

- Industrial production y/y +2.7% vs +4.4% expected

- Prior y/y +5.2%; revised to +5.3%

- Q4 employment change q/q +0.3% vs +0.4% prior

- Q4 employment change y/y +1.6% vs +1.7% prior

The fall was mainly due to energy goods which fell by 6.6% m/m, and 10.4% y/y. Durable consumer goods were also down 1.9% m/m and 3.8% y/y.

Not a major data point, but certainly not as strong a start to the year than expected. Although it is a lagging indicator, it is one that fits the narrative that we may have seen the Eurozone economy peak in December last year.

A caveat though, like a lot of the recent Eurozone figures, the industrial production data calculation has been changed to reference year being 2015 - not sure how much that has played into the numbers though.

Meanwhile, employment figures continue to show a recovering labour market with the number of men and women employed in the EU28 and Euro-area being at the highest levels ever recorded. The full report can be found here.

EUR/USD at 1.2369 currently, not much movement since the fall earlier. EUR/GBP at 0.8864 largely range-trading still. EUR/JPY at 131.85 just off the lows for the day.