Latest data released by Markit - 1 October 2020

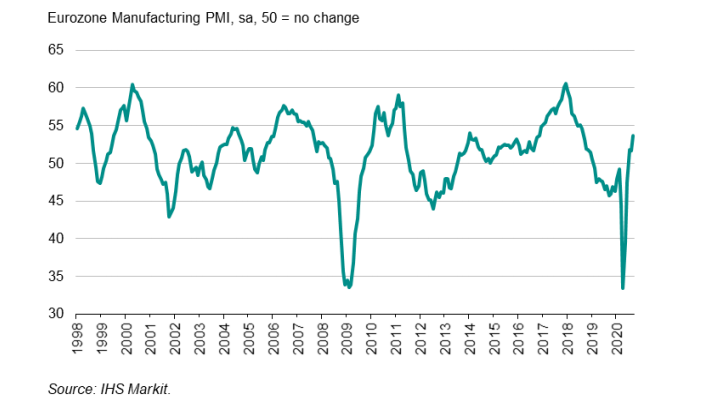

The preliminary report can be found here. No change to the initial estimate as this reaffirms a modest pickup in euro area factory activity last month, despite concerns surrounding the virus situation in the region.

That said, all this does is confirm a two-paced recovery towards the end of Q3 with the services sector expected to lag further amid the resurgence in virus cases - which we already saw with the preliminary reports (link above).

Markit notes that:

"The eurozone's manufacturing recovery gained further momentum in September, rounding off the largest quarterly rise in production since the opening months of 2018. Order book growth and exports also accelerated, indicating a welcome strengthening of demand. Job losses consequently eased as firms grew more upbeat about prospects for the year ahead, with optimism returning to the highs seen before the trade war escalation in early 2018.

"The recovery would have been far more modest without Germany, however, where output has surged especially sharply to account for around half of the region's overall expansion in September. Germany's performance contrasted markedly with modest production growth in Spain, slowdowns in Italy and Austria, plus a particularly worrying return to contraction in Ireland. Excluding Germany, output growth would have weakened to the lowest since June.

"Divergent export performance explains much of the difference between national production trends, with Germany the stand-out leader in terms of growth in September, led by a strengthening of demand for investment goods such as plant and machinery.

"Encouragingly, optimism about the future rose not only in Germany but also in France, Italy, Spain and Austria, hinting that the upturn could broaden out in coming months. Without a more broad-based recovery, the sustainability of the upturn looks at risk, with additional worries fuelled by rising Covid19 infection rates."