Forex news for US trading on Nov 12, 2015:

- NY Fed President Dudley: It's possible that liftoff conditions will soon be satisfied

- Q&A Dudley: Economic news has been ok in past couple months

US initial jobless claims 276k vs 270k exp - Fed's Bullard: No reason to continue 'extreme' monetary policy

- El Niño forecast to be 3rd strongest on record

- US Oct budget deficit $136.5B vs $130B expected

- "The housing market is broken" - BOE's Haldane

- ECB's Weidmann: Economy not doing too badly

- Fed's Bullard says 'gradual' will be defined by second move

- BOE's Haldane: Rate rise a long way off based on current data

- Evans: FOMC will try to figure out what to say on rate path

- Eurozone needs comprehensive shift of sovereignty says Weidmann

- US EIA weekly oil storage +4224K vs +1300K expected

- 92% of economists on board for Dec rate hike

- Evans sees FFR at 0.75% 1.0% end of 2016

- Lacker says CPI target is still appropriate

- Fed's Evans says he needs to see inflation rising before hiking rates

- US Sept JOLTS job openings 5526K vs 5400K expected

- It's plausible that QE had scant real effect on the economy says Fed's Lacker

- Canadian Sept new housing price index +1.3% y/y vs +1.3% y/y expected

- OPEC monthly report has global oil demand growth forecast unchanged at 1.25mln bpd

- S&P 500 down 29 points to 2046

- Gold down $2 to $1084

- WTI crude down $1.31 to $41.62

- US 10-year yields down 1.7 bps to 2.31%

- AUD leads, NZD lags

The USD-stock market correlation was higher than ever Thursday. It was a tick for tick trade in the US dollar and stock markets today.

It hit a crescendo at the end of the day as the S&P 500 fell 29 points to 2046 to end the day and the euro blasted to a session high at 1.0830.

It's all about investment flows at the moment. The US is by far the best market in the developed world for growth and the money is flooding in. Occasionally, there are jitters in stocks and corporate bonds and the money gets skittish.

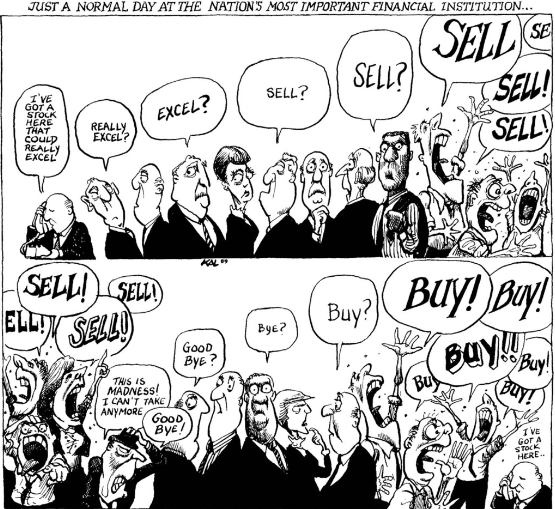

What set it off today? That's a tough call. There wasn't anything particularly notable from the 5 Fed speakers today (Fischer still to come). But they were inconsistent and that creates a bit of uncertainty.

Tomorrow is the retail sales report so there could be some jitters.

But for the most part it's just the ebb and flow of an inefficient market that's doing its best. Oil stocks took a hit and then the selling took hold.