September has been a month of consolidation so far for the euro after the fall from 1.3993 and it’s to be expected. Despite the fact that there are still many willing sellers waiting for any big break above 1.30 to hit into there’s no real effort to drive the price down further. This increases the chances that we will see some sort of bounce as it can mean that shorts are nearing their limits on pushing the price around.

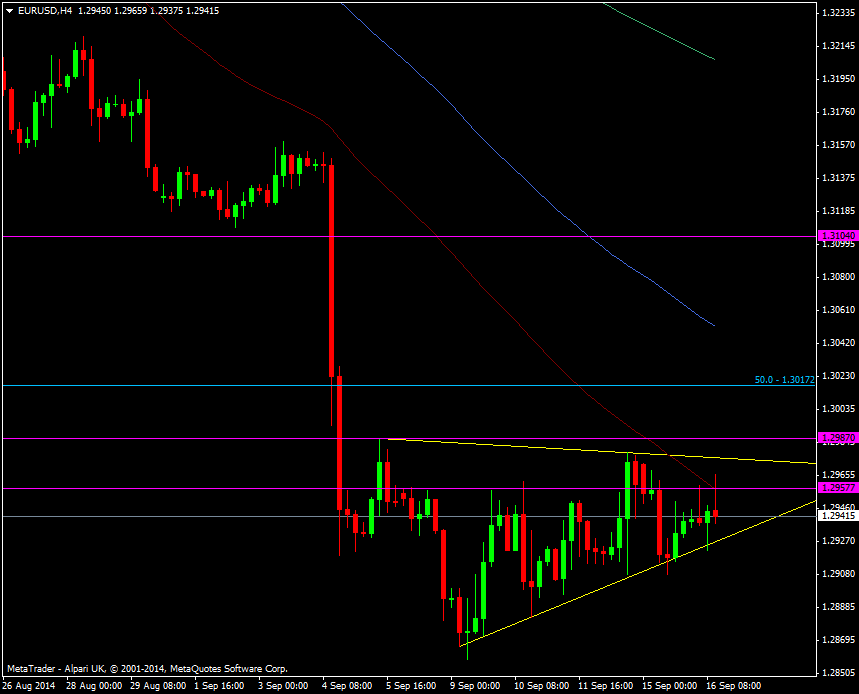

EUR/USD H4 chart 16 09 2014

Buyers are slowly pushing the price up but it still all seems touchy-feely stuff with no real effort to bust a move out of the range. The next catalyst for a euro move will be tomorrow’s revised HICP report but we don’t usually get a big variation. That said, at these levels a 0.1% move will be like a fairly big move, especially if it edges inflation closer to the zero line.

The chart above gives us the intraday range to play about in and the break of the topside looks to be the one that will gain most pips in normal circumstances.

There’s little on the US calendar to shake markets up so we’ll be hanging on for any soundbites. US PPI final demand gives us some price data at 13.30 gmt +1.

The market is looking for a flat month at 0.0% from 0.1% prior and a slight tick up in the year on year figure to 1.8% vs 1.7% prior