The EURUSD moved above the 2013 lows at the 1.2746-57, extending up to a high of 1.2790. The 1.27865 was the broken 61.8% retracement for what it is worth. The price is now back below the 2013 lows and the market seem comfortable selling the pair back down.

The EURUSD moved back abov e the lows from 2013, but back below these levels now.

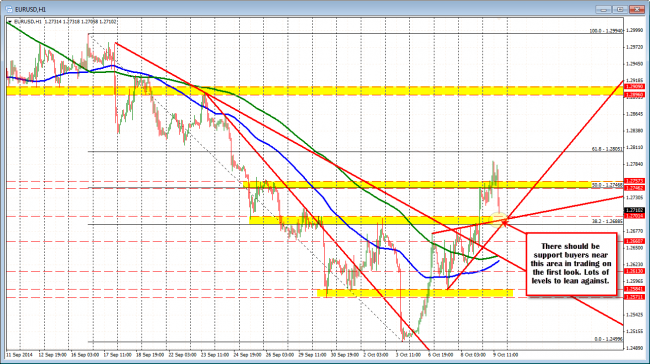

Looking at the hourly chart, the price is approaching the break area from yesterday at the 1.2688 – 1.2701. The 1.26885 is the 38.2% of the move down from the Sept 16 high. The 1.2701 is the high prices from September 30th (see chart below. A trend line cuts across that connected highs from this week (broken yesterday on the FOMC statement).

EURUSD is approaching support at the 1.2701 area.

The price is lower on the day but I would still expect dip buyers against this area as a trade today. If the price breaks below the trend line I would look be wary but there are a bunch of reasons to buy against the area, so it is worth a trade on an intraday basis. Having said that the 1.2746 becomes tough resistance again.