The Fed did nothing to dissuade market pricing

The Federal Reserve knows what the market expects.

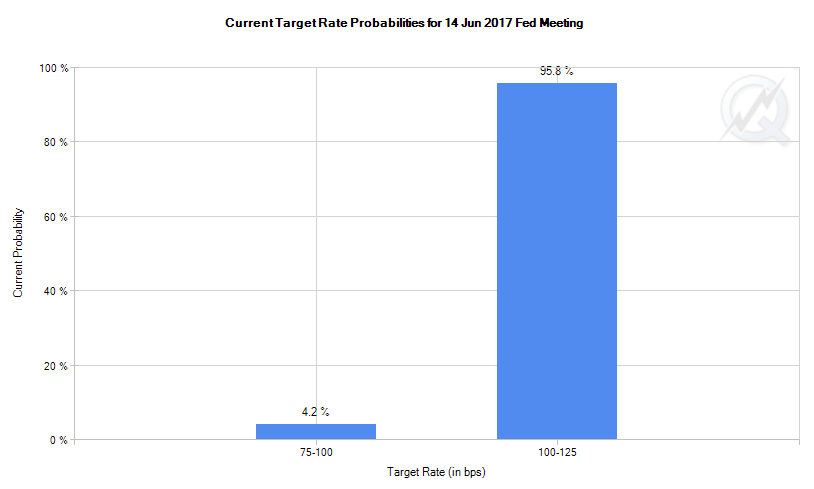

Despite the setback in nonfarm payrolls, the CME Fedwatch tool pegs the implied probability of a June 14 hike at 95.8%.

A big reason it's so high is because Fed officials have remained silent. If they wanted to pause, or were seriously contemplating not hiking, then a top official would have said something.

Now, it's too late. The Fed blackout period starts tomorrow. There will be no more commentary from FOMC officials until Yellen's press conference June 14.

In the recent past, the Fed has managed expectations. Shortly before the March FOMC the market wasn't aggressively pricing in a hike so NY Fed President Dudley scheduled an impromptu appearance on CNBC and tipped his hand.

This time, nothing.

Barring some kind of great unforeseen shock in the next 12 days, a hike is guaranteed. The big question now is what signals they send about later in the year. At the moment, a 30% chance of a September hike is priced in.