This crisis might just be getting going

A month ago, no one was talking about the brewing energy crisis in Europe and elsewhere but we were.

Now talk about energy is everywhere but that doesn't mean it's peaked.

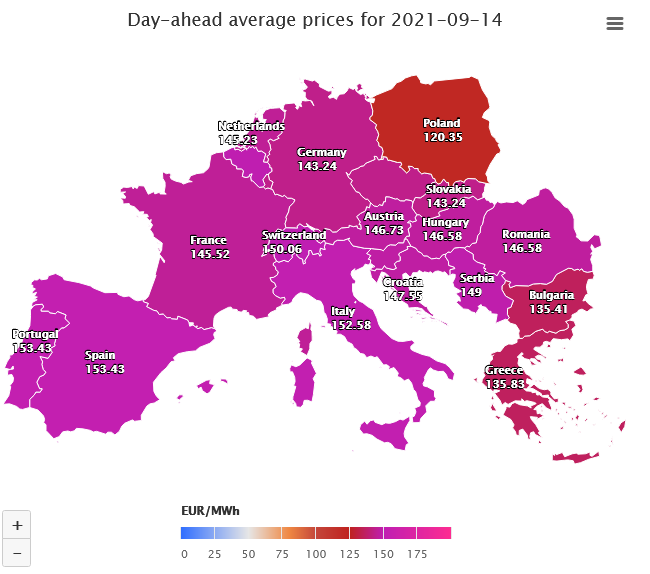

Here's how power prices looked on Sept 14 in Europe:

Here's how they look today:

Spare a prayer for anyone in heavy industry in Italy.

Of course though, everyone is now being subsidized by the government. The result of that is that demand won't be destroyed and the crisis will simply be prolonged. I'm not sure they have any other choice.

Power is the most-fundamental ingredient in any modern economy.

China has ordered energy providers to stockpile supplies 'at any cost'. A failure to provide energy is a fundamental failure of a government.

The problem is that it's not just a natural gas shortage anymore. Coal prices have gone stratospheric and this chart from HFI caught my eye today.

Aside from pricing, I wonder if there is even sufficient port and shipping capacity to fix this any time soon.

The next leg of the blowup could be oil. Prices hit seven-year highs today and one reason is that anyone who can switch to oil from natural gas is doing exactly that. Estimates from Saudis, Goldman and Vitol put that at anywhere from 500k bpd to 1 mbpd right now and it could rise substantially in the winter.

I don't think European natural gas prices can rise indefinitely and might have already peaked but just staying near these levels is an incredible burden on economies and consumers. I also can't rule out prices going much higher. It's tough to destroy demand for heat and power, especially when subsidies are an option.

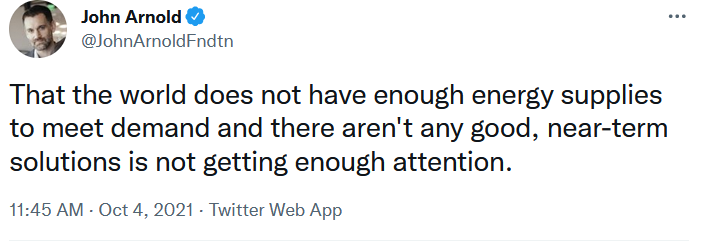

Don't take my word for it, here's a guy who became a billionaire at 33 in 2007 by trading oil.

Or forget about all of this and simply have a look at the huge potential breakout in oil prices that's unfolding today: