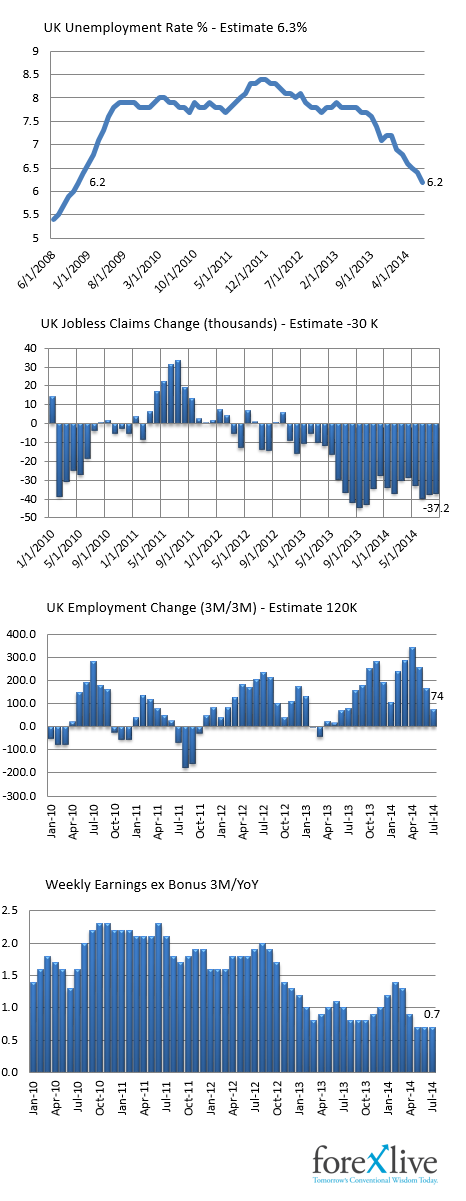

If you look at the BOE Meeting Minutes, the list is more dovish than hawkish (see https://www.forexlive.com/blog/2014/09/17/boe-mpc-minutes-insufficient-price-pressure-to-justify-rate-rise/ ). Yes, Weale and McCafferty kept their vote for 0.25% rate hike again. So there was that element which is hawkish. However, the other stuff was more of a list of the concerns. Meanwhile, the Employment picture continued to improve with the Unemployment rate falling to 6-year lows, but the wage issue (i.e., slack) remains as the YoY take home pay remained at the all time low at 0.7%. Below is a historical look at the major employment components from the UK.

Unemployment at 6 year low. Wages at record lows (slack?)

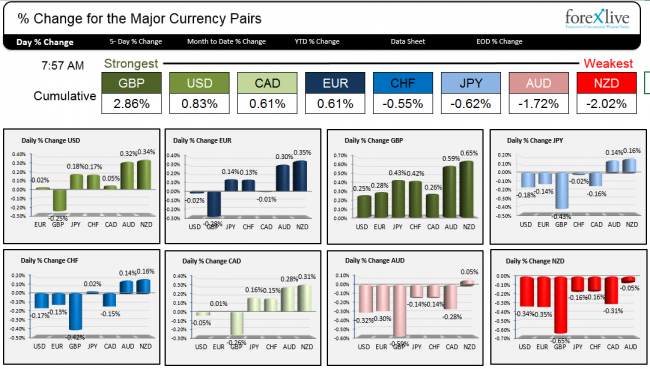

Despite all the information today out of the UK – some good and some not so good – the GBP is the strongest currency of the majors as the next major event unfolds with the Scottish vote tomorrow. The market seems to be more comfortable with the “No” vote and may be looking for some unwind of the selling that has taken the pair down from 1.7189 to 1.6050 since July. It has been a long run. Nevertheless, there is additional risk of course so pick your battles and be sure to focus on the risk.. Trade smart. Don’t gamble.

The weakest currency is the NZD. Last week, the RBNZ said that the currency was still overvalued and was likely to have a significant fall. The Current Account showed a deficit of 1.065b overnight. GDP for the 2Q will be released later (6:45 PM ET) with the expectations of a 0.6% QoQ increase and 3.8% increase YoY (doesn’t seem too shabby, but it is old news). The NZD rallied in trading yesterday on the back of the PBOC liquidity infusion but those gains are being unwound in trading today.

Below is a list of the winners and losers.

The US will release CPI data, along with the Current Account Balance (-113.4B for 2Q estimate) at 8:30 AM ET. The NAHB Housing Market index is espected to rise to 56 from 55 last month. There is that little thing called the FOMC Rate Decision at 2 PM followed by Chair Yellen’s press conference at 2:30 PM. The rate will stay the same. The QE bond purchase pace will subtract 10B (only one more to go) and the statetment is “supposed” to keep words “considerable time” in the statement (read what Adam has to say HERE).

The Forex Winners and Losers for the day (% change vs the Major currency pairs)