Latest client note from DB courtesy of our friends at efxnews.com 27 July

Say DB:

The Fed could not have wished for more sanguine financial markets, or a more benign international events calendar and data backdrop. It begs the question: in a volatile world will 'the ducks' ever align so perfectly for a tightening, and will the Fed miss their opportunity?

The ducks have aligned:

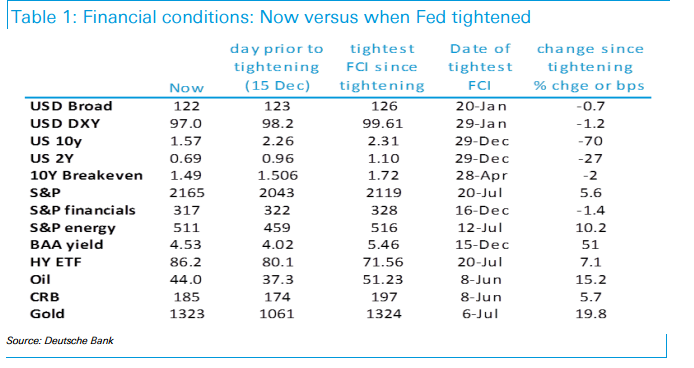

Compare key financial condition indicators to when the Fed tightened in December: the S&P is ~6% higher and nudging all-time highs; the 2y and 10y yields are 26bps and 66bps lower respectively; the Broad TWI dollar is slightly softer; high yield bond prices are substantially stronger and related commodity prices are healthier.

Compare event risks: Rmb day to day variation/depreciation is being readily absorbed; Brexit has passed, and related contagion fears for the US are proving greatly exaggerated.

Compare the numbers: For November 2015 prior to the December 2015 FOMC rate hike, the ISM manufacturing is up close to 5pts; 3m avg of retail sales ex autos is up from zero to over 8% annualized; 3m avg of NFP has decelerated from 241K to 147K as might be expected at this point in the cycle; and the U3 unemployment and U6 'underemployment' rates are down 0.1% and 0.3% respectively.