January to March CPI data is due from New Zealand on Thursday in NZ at 10.45am local

- Which is Wednesday at 2245GMT (NZ is 12 hours ahead of GMT at present)

I popped a preview up yesterday, here:

More now, this via BNZ:

For the March quarter result, we suspect the RBNZ will have been modestly surprised by softer than expected food prices and, possibly, lower than anticipated fuel prices. But it's not these factors that are making the most negative contributions to the quarterly outturn. The single biggest downward contribution is likely to come from the education group. This is where free education for first timers in the tertiary sector shows up. It's difficult to know exactly the impact of this but we are gunning for a -0.2% contribution to the quarterly CPI.

- The other big negative contribution is likely to come from the transport group - not from fuel prices but passenger transport services. This is because international airline prices typically plummet in the March quarter each year reversing the usual surge in December.

- On the flipside, the inflation that will appear is likely to be driven by cigarettes and tobacco (thanks to the excise tax lift) and it would be a real surprise if the housing and household utilities group didn't have a substantial impact.

Note that the 0.4% quarterly projection that we are delivering today is higher than the 0.3% attributed to us in various market surveys. That's because we were surprised by ... news that food prices jumped ... March by 1.0%. We knew that poor weather was going to push fresh vegetable prices higher but we hadn't expected the 10.6% increase that occurred in this subgroup. Accordingly we have pushed our pick a notch higher though we note that this increase will be unwound in due course as growing conditions improve.

This via Westpac:

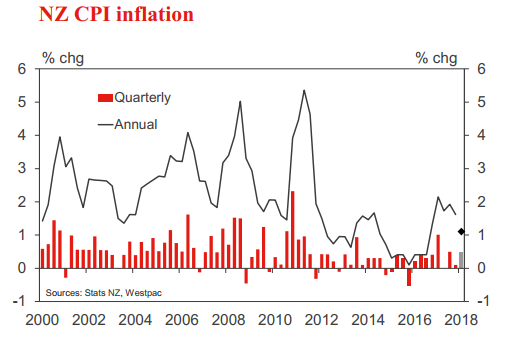

- We expect a 0.5% rise in consumer prices for the March quarter, barring any major surprise in March food prices (released on Monday). This would bring annual inflation down from 1.6% to 1.1%, the lowest since September 2016.

- There are two factors behind the drop in annual inflation. The first is the introduction of a years' free tertiary education, which we estimate will take 0.2% off the CPI. The second is base effects: a surge in oil prices a year ago saw annual inflation rise to 2.2% in March 2017, before dropping back to 1.7% in June.

- The dip in annual inflation this year will be similarly short-lived. Setting aside the expected volatility, underlying inflation remains subdued. The lower New Zealand dollar over the last year will add to tradables inflation, but domestic inflation pressures have yet to pick up.

(as a ps. to that first point from WPAC - I have not seen any change to their forecast as of posting, still at 0.5% q/q & 1.1% y/y)