Forex news for US trading on October 28, 2015:

- Fed statement says they're ready to hike in Dec

- Fed cuts "global and economic restraints" part of statement

- Federal Reserve leaves rates on hold

- US Sept advance trade deficit $58.63B vs $64.3B expected

- Deutsche Bank to eliminate 2015 and 2016 dividends

- Hilsenrath: Fed offers hint of December hike

- ECB Noyer: QE needs time to bear fruit

- Atlanta Fed GDPNow Q3 GDP +1.1% vs +0.8% prior

- ECB's Constancio: No sign of general asset overvaluation in eurozone

- ECB's Constancio sees signs of weak demand

- US EIA crude oil inventories +3376K vs +3560K expected

- Iran to pump more than 500K bpd after sanctions - Shana

- Gulf OPEC countries oppose summit with non-OPEC countries

- Gold down $11 to $1155

- WTI crude up $2.77 to $45.97

- US 2-year yields up 8.2 bps to 0.70%

- Implied prob of Dec hike at 46% vs 34% before Fed

- S&P 500 up 24 points to 2090

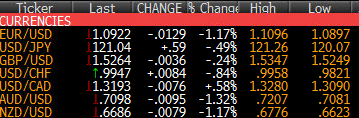

- USD and CAD lead, AUD and NZD lag

The hawkish Fed sent the US dollar skyward. The chance of a December hike jumped and the market reaction was rather unsurprising except for the jump in stock markets.

The US dollar soared and that sank the euro to 1.0897 from 1.1070. The first move came quick in a drop to 1.0950 and then the final 50 pips were more gradual. After taking out the big figure about 40 minutes after the FOMC, there has been a modest bounce to 1.0924.

Before the FOMC the them was mild US dollar selling but it was more pronounced versus GBP and CAD. The story in CAD, as usual, was oil. Crude jumped more than 6.4% in an epic squeeze after declining in 6 of the past 7 days. The inventory numbers were a fraction better than expected but not enough to trigger that kind of move. In any case, USD/CAD was long for the rid as it tumbled to 1.3090 from 1.3240 at the start of US trading. After the Fed it rebounded to 1.3188.

Cable was underpinned by EUR/GBP selling. It had ticked lower in European trading and bottomed at 1.5275 after the US trade numbers gave the dollar a broad lift. It chopped for a period and then jumped to 1.5345 on the aforementioned USD slide, EUR/GBP selling and some UK flows. After the Fed, however, it was down to a session low at 1.5245 before a late bounce to 1.5271.

The Australian dollar was at a post-CPI high at 0.7159 ahead of the Fed. It had slowly been recovering alongside commodities but it was kicked down to 0.7080 afterwards. Again, it's finding buyers and up to 0.7107.

Despite broader USD selling before the Fed, the dollar made some ground against the yen in a slow chop to 120.50 from 120.35 in the hours leading up to the decision. Afterwards, it shot higher to 121.27 before a late fade to 121.02.