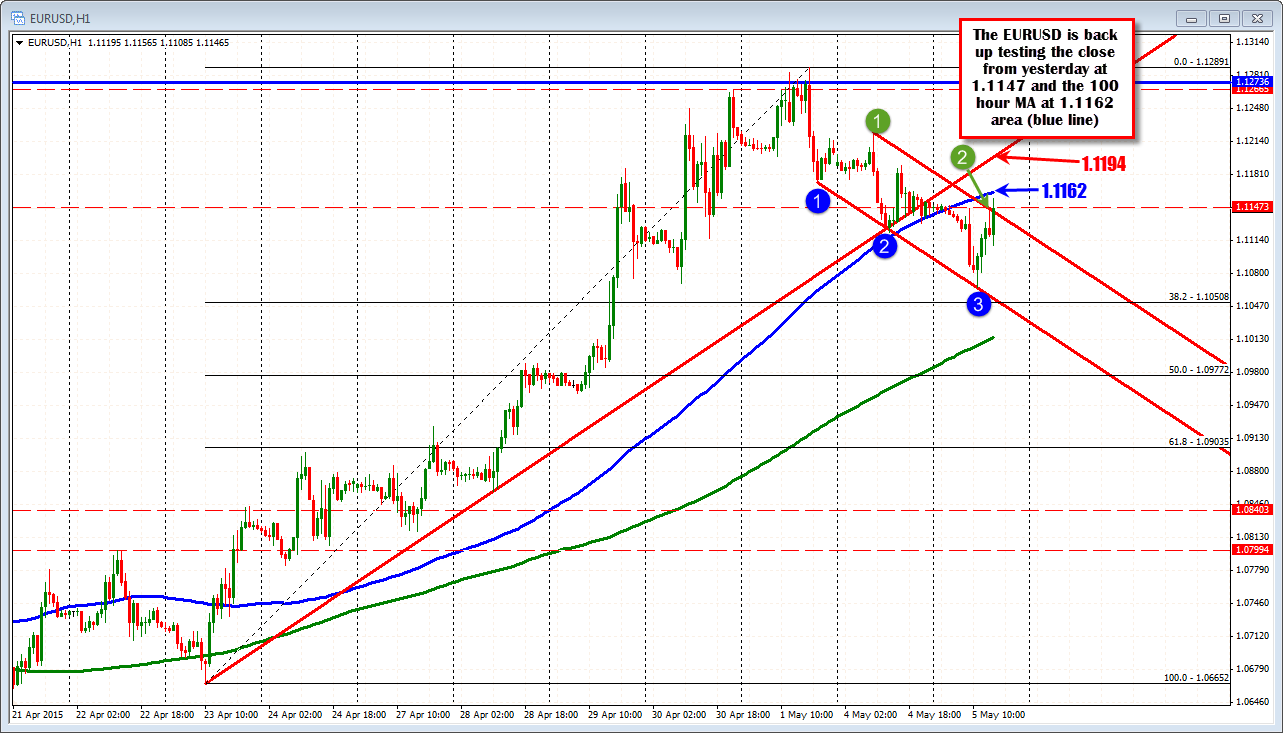

Bounces off trend line support. Test 100 hour MA.

The EURUSD spent most of the NY session yesterday above the 100 hour MA (blue line in the chart below). In the Asian Pacific session, the price started to wander below and as European traders entered, the price started to move more sharply lower. Concerns about Greece/IMF support was cited. This was a rehash of report outlined in the NY session. The subsequent fall in the pair, took the price to the lower trend line support. The level held as risk was defined and limited and the price moved higher.

With the US trade numbers coming out much weaker than expectations (expect GDP for 1Q to move even lower - negative?), the pair has now moved above a parallel topside trend line and even peaked above the close from yesterday at 1.11473. The 100 hour MA remains a hurdle above (blue line). That comes in at the 1.11627 level. A move above will next target the underside of the broken trend line. That level comes in at the 1.1194 level currently.

Is there a favored way? When the price starts doing laps to the downside and back higher, but remains below things like the 100 hour MA, trading from this point becomes a coin toss. However traders can sell against the 100 hour MA with little risk and look for a rotation. lower. Alternatively those who have jumped on the topside move, we are above the close from yesterday and the intraday MA on the 5 minute chart (see blue and green lines in the chart below). That could be the risk/support. PS since the push higher after the trade data, the close from yesterday is holding. So there is a mini battle vs the 100 hour MA above and the close going on as we speak.

Looking further out, the low for the day not only stalled at the lower trend line but also in the area defined by the January 26 low and the highs reached in March.

Not to make things even more wishy washy but holding that level is bullish. The stall against the 100 day MA on Friday was bearish (blue line in the daily chart below). It is safe to say that traders are being patient, picking spots and perhaps scalping between as they wait for Yellen (tomorow)/US employment (Friday), to provide the next major catalyst.