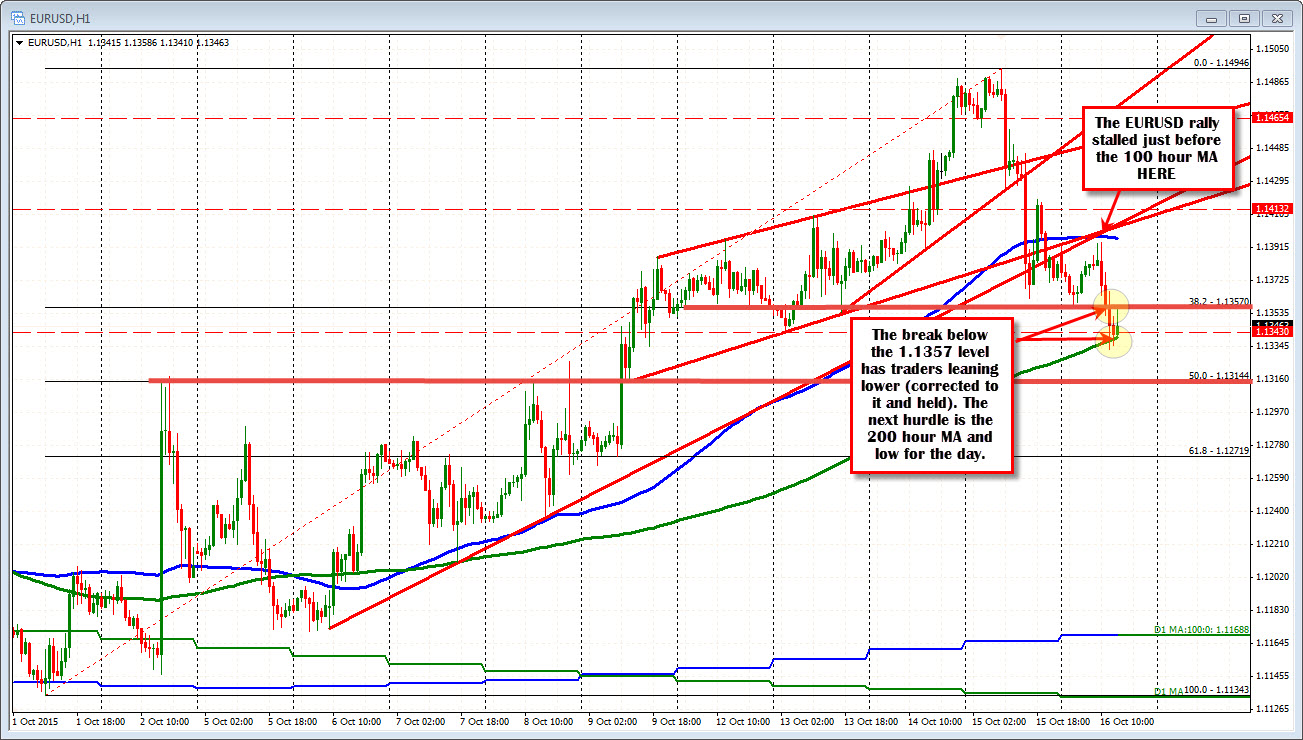

200 hour MA a downside hurdle

The EURUSD is down on the day and in the process extended the trading range for the week. The range is now 161 pips. The lowest trading range has been 148 pips this year. The price is also now down for the week. Last week saw the price end at 1.1356.

Is there more downside fuel in the tank?

Well, there are a couple of technical levels of importance to me.

1. The 1.1357 area. This is the 38.2% of the move up from the October 1 low.

2. The 200 hour MA at the 1.1338 level (and the low at 1.1333).

Stay below 1.1357 and get and stay below 1.1333-38 area.

The correction off the low took the price to the 1.1357 area and the price held (the high reached 1.13585). Good for the shorts. Now the price is back down testing the lower extreme.

A break will next target the 50% of the October trading range at the 1.13144 level. This is near highs from over 2nd and October 8 and swing low from October 9 (after the break higher). This makes on level a pretty strong support target for today. Look for buyers against it.

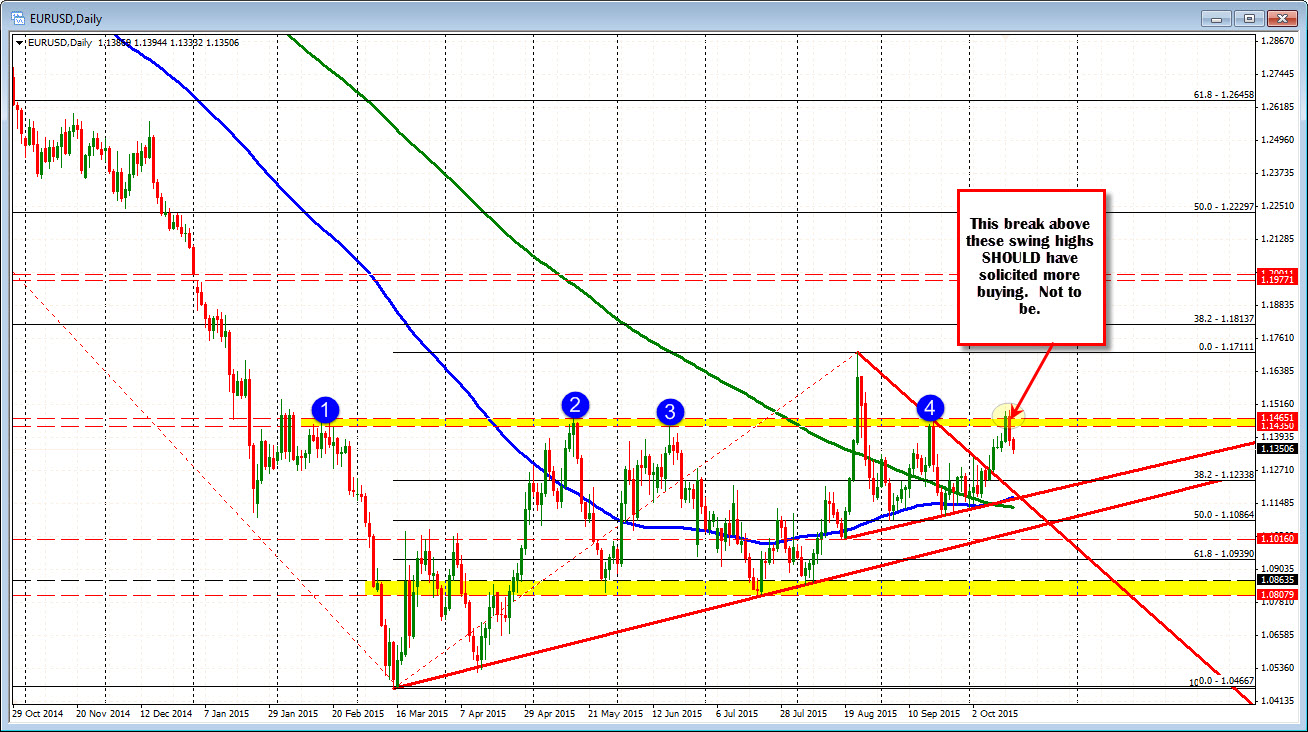

What is the daily chart showing?

The pair had the technical opportunity to extend higher this week. The ceiling area at the 1.1435-65 was breached (see chart below). That was an open invitation to go higher. Not to be. The price rotated lower yesterday. There is still a chance the fall is still a correction for another run at the highs (hence the importance of the 50% level below). A break below that level will help the sellers confidence.

It is Friday. That means anything can happen as traders square, but we can. US data includes industrial production and capacity utilization at 9:15 AM ET. The jolts job openings for August at 10 PM and the University of Michigan sentiment index for October also at 10 AM.