Trends lower but between support and resistance

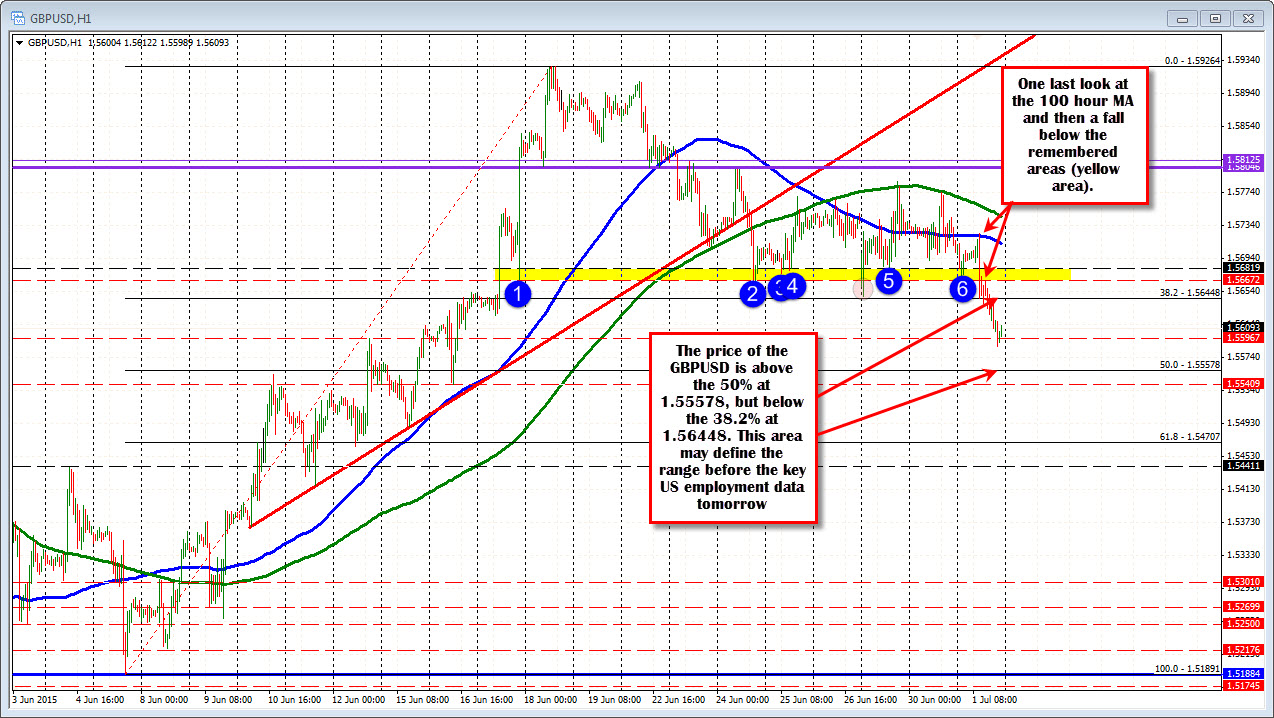

The GBPUSDs move down today was started by finding sellers against the 100 hour moving average (blue line in the chart below). Holding the line there (with a little help from BOE Carney) helped to push the price below what was a key "remembered area" defined by swing lows going back to June 17. That area came between 1.5667 and 1.56819. Getting below that area (see yellow area in the chart below) and staying below was a catalyst for continued selling pressure in the GBPUSD today. It has been a steady grind to the downside.

Looking at the hourly chart, the price has stalled between the 38.2% and 50% retracement of the move up from the June 5 low to the June 18 high. That area comes at 1.55578 and 1.56448. With the important US employment statistics out on Thursday in the US, the market may have found a neutral area to hang around before the data is released tomorrow at 8:30 AM ET. Look for support buyers near the 1.5557 area (50% retracement level)and any rally toward the 1.5644 (38.2% retracement level) to find traders selling.

The comments from Carney today seem to suggest that the Bank of England is more willing to see how the cards settle within Europe before acting. This may delay any thoughts of a rate rise and keep the GBPUSD. Then again, the Federal Reserve may start thinking the same way (at least behind closed doors). The US employment statistics tomorrow will also be a key release for the direction of the dollar and the GBPUSD. With less important data out in the UK (Nationwide house price changes for the month of June are expected to show a gain of 0.5% MoM and the Markit UK Construction PMI is est 56.5 vs 55.9), the focus will be on the US data. Non Farm Payroll jobs are expected to rise by 233K vs. 280K. For a full preview of the report, check out Adam's post HERE.

PS Congratulations to Roberto - recent Attacking Currency Trends course attendee who sold the break back into the "remembered area" and rode it to the lows.for an 80 pip gain.