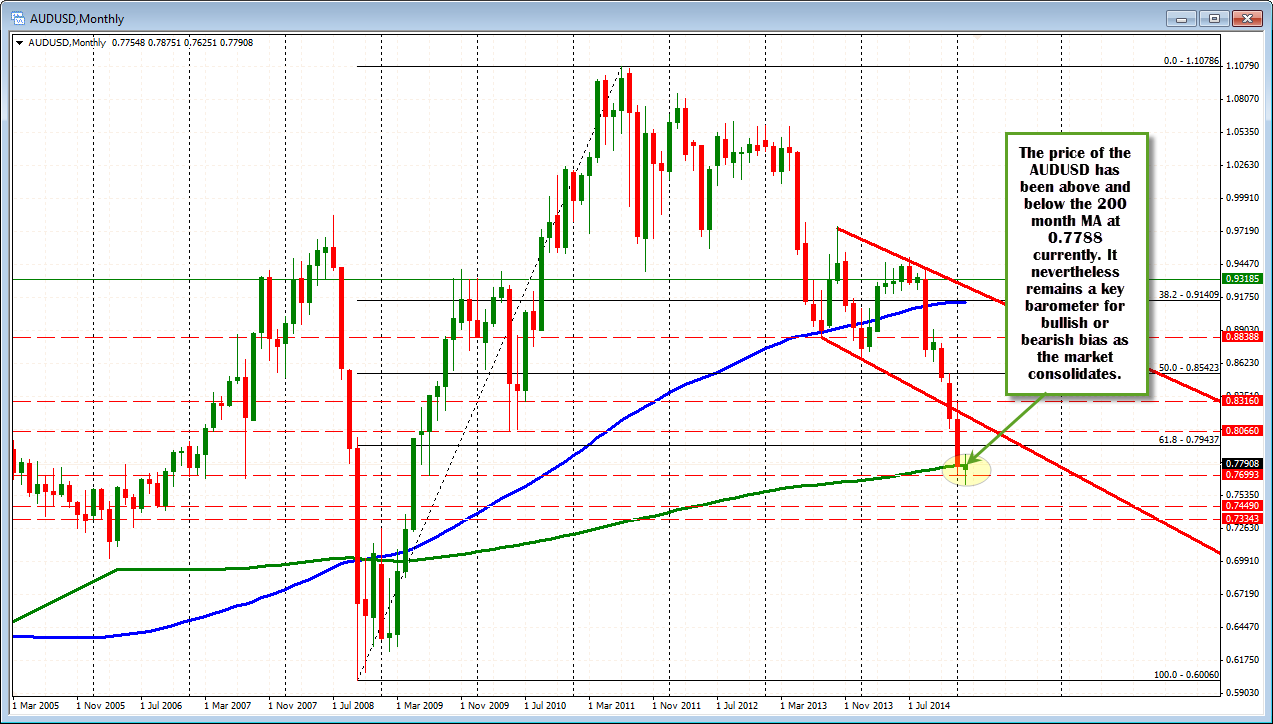

200 month moving average tested in quiet trading

The AUDUSD has drifted lower in trading today. The pair stalled, after the new highs were reached in far east session, failed to ignite any additional buying momentum. The subsequent move to the downside is modest (around 46 pips from the high so far).

The price is stalling near the 200 month MA at the 0.7788 area (see last night video focused on the AUDUSD). The next targets on the downside come against the 100 and 200 hour MAs at the 0.7777 and 0.7772 levels. If the price is swing the bias back toward the downside, a break and staying below all these levels will be eyed.

Helping to support the inactivity of late is the steady iron ore prices. Looking at the chart below, the price of iron ore (a key export from Australia) has steadied in February. This has allowed the 50 day MA to catch up to the price. That moving average has been breached (the most recent back in July/Aug) but the moves above have been limited. A move above this moving average would be needed to help confirm a potential bottom is in place for this commodity.

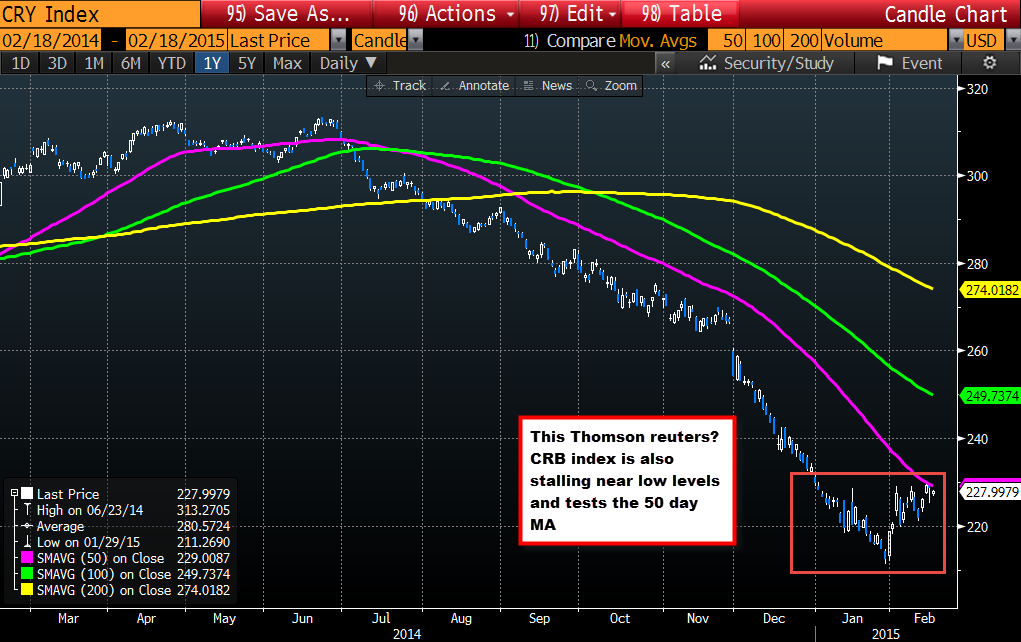

The Thomson Reuters/ CRB index is also stalling at low levels. This index is a compilation of commodities (energy, grain,industrial, livestock, precious metals and soft commodities).It too has caught up to the 50 day MA and is at a key crossroad. A move above that moving average would be step one in calling a potential bottom in commodities (which should help the AUDUSD). Until then, however, the sellers remain in control.