From a Credit Agricole client note:

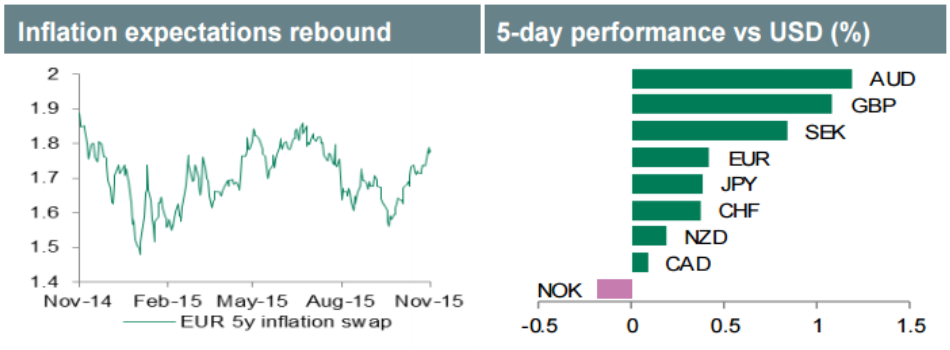

The USD-rally has reached a stage where investors will look for signals from the policymakers and the data to decide whether to add to their longs at the current elevated levels. We remain constructive on USD but suspect that its outperformance should become less uniform across G10 in the coming days.

We see the biggest scope for USD-outperformance against risk-correlated and commodity G10 currencies. We think market risk sentiment should weaken from here as the December Fed lift-off draws near and global commodity prices remain under pressure.

At the same time, we expect liquid safe-haven currencies to remain relatively resilient. We think that EUR in particular could consolidate given that the latest selloff has pushed EUR NEER very close the ECB's comfort zone and that Draghi will struggle to exceed the already dovish market expectations.

JPY could face upside risk in an environment of rising risk aversion. Although we expect the broader depreciation trend to continue, we believe better levels may be reached for entering new longs in USD/JPY.

What we're watching:

EUR/USD outlook: steady grind lower but no parity. EUR NEER should go back to the ECB's comfort zone (this year's lows). EUR/USD at parity is not our base case, however. (for more details, see her).

USD - Unless next week's inflation data were to surprise considerably lower, we anticipate limited impact on rate expectations and the currency.

EUR - Some upside correction risk cannot be excluded given markets have priced in both an extension of QE and a deposit rate cut.

GBP - Next week's retail sales release is unlikely to make a case of rising rate expectations to the benefit of the currency.

JPY - We remain of the view that the BoJ will not ease anew ahead of January. As such the JPY should be driven by risk sentiment.

XAU - Gold prices are likely to find a base on the back of more unstable risk sentiment. However, the still strong USD is likely to limit any upside.

For trades and levels from Credit Agricole and other banks, check out eFX Plus.