Forex news for US trading on Sept 1, 2015:

- Canada Q2 GDP -0.5% vs -1.0% expected

- August ISM manufacturing 51.1 vs 52.5 expected

- ISM's Holcomb: Comments in survey show concern with USD and exports

- Fed's Rosengren: Reasonable confidence on inflation not as clear cut

- SNB's Jordan opens the door to another rate cut

- SNB's Jordan: Prepared to intervene in FX market if necessary

- Markit US August final manufacturing PMI 53.0 vs 52.9 expected

- Fonterra New Zealand dairy auction results: +10.9%

- US construction spending for July +0.7% vs. +0.6% estimate

- US August auto sales were the highest since July 2005

- Dallas Fed Aug service sector activity +2.1 vs +7.9 prior

- Canada RBC Manufacturing PMI for August 49.4 vs 50.8 in July

- We will declare the end of deflation when there's no risk of deflation says Amari

- China will lower capital requirement for investments - BBG

- Atlanta Fed sees Q3 GDP at 1.35% vs 1.40% prior

- Brazilian real weakens 2% to lowest since Dec 2002

- WTI crude down $4.92, or 10%, to $44.27

- S&P 500 down 58 points, or 3%, to $1913

- US 10-year yields down 6.5 bps to 2.15%

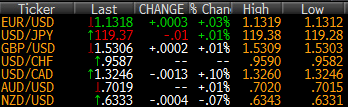

- JPY leads, AUD lags

Three days of calm didn't mask the underlying market jitters. There wasn't a particular trigger for the worries. The China PMI was a touch better than expected but it was still the worst reading since the crisis.

The turn of the calendar was probably responsible and looking through the calendar is like a murderers row with Tier 1 data every day this week and the Fed still talking about hiking. The ISM manufacturing data was soft and worries turned into fears.

The FX market was surprisingly calm in US trading. USD/JPY refused to break the Asian low of 119.53 until the very end of trading.

EUR/USD slipped to 1.1231 early but formed a double bottom there and then slowly climbed to 1.1316, just 15 pips from the Asian high.

Cable was on the defensive but the lows are holding so far at 1.5300. It's the sixth consecutive decline in cable.

Oil was absolutely ransacked in a 10% swan dive that was slow to start, had a bounce at midday and then finished on the lows after API. USD/CAD had to weigh that against a GDP that didn't show the economy contracting as much as anticipated. Still, we're at the daily highs at 1.3242 from as low as 1.3100.

The Australian dollar popped on the RBA yesterday but the central bank is looking at the same factors as everyone else and instead began a tumble to 0.7015, more than 135 pips from the highs.

It's not looking pretty out there.