Forex news for Asia trading on Monday 01 November 2021

- Morgan Stanley on US stocks - bullish trend but not for much longer

- Governor of Taiwan's central bank says watching other countries to help guide rate hike timing

- People's Bank of China told local lenders to keep total local property loan volumes stable

- China - Caixin Manufacturing PMI 50.6 (vs. expected 50, prior 50)

- OPEC+ meet this week. 400K barrel increase likely to remain, but some prospect of more.

- PBOC sets USD/ CNY reference rate for today at 6.4192 (vs. estimate at 6.4174)

- Australia data, Housing finance for September: Value of home loans -1.4% (expected -2%)

- Australia data - ANZ job ads for October +6.2% m/m

- Japan - Jibun Bank/Markit Manufacturing PMI (final) for October 53.2 (prior 51.5)

- RBA bought bonds again today, but none of the April 2024

- Australia monthly inflation indicator +0.2% m/m and +3.1% y/y

- South Korea exports - surge continues in October

- Goldman Sachs on oil - says the bull run is intact

- More on EU's Sefcovic warning UK not to embark on 'confrontation' over Northern Ireland

- Goldman Sachs on the Fed (rate hike coming in July '22), US tax plan (less of a risk to equities) & COVID-19

- RBA meeting Tuesday 2 November - Australian analyst says "no rate hike until 2024" promise to be dumped

- EU's Sefcovic has accused the UK of seeking a Brexit fight

- Australia - Markit Manufacturing PMI for October (final) 58.2 (prior 56.8)

- The RBA may require a capital injection from the Australian Treasury

- White House Press Secretary Jen Psaki says she has tested positive for covid

- Australia - AiG Manufacturing PMI for October 50.4 (prior 51.8)

- Japan earthquake north of Tokyo - magnitude 5.2

- The US and EU reached an agreement on steel over the weekend

- Bank of England meet this week - how the 9 votes will fall

- Remarks from US President Biden - expects voting on his program this week

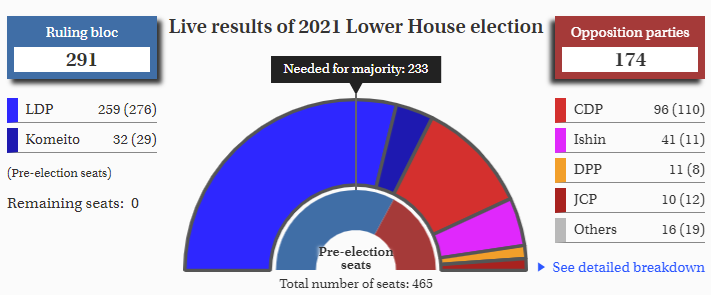

- Japanese election - PM Kishida returned to power

- NZD traders - RBNZ Governor Orr will be speaking on Tuesday

- Heads up for time zone changes - UK & Europe

- Monday morning open levels - indicative forex rates - 01 November 2021

- China October PMIs: Manufacturing 49.2 (prior 49.6) & Services 52.4 (prior 53.2)

- November seasonals: Six trends to watch in a month with some strong signals

- G20 leaders to endorse global minimum tax deal, want it in place in 2023

China kicked off the data flow over the weekend with disappointing (official) PMIs for October. Some amends were made on Monday though with the private survey manufacturing PMI improving. In a nutshell the official PMI survey larger and many state-owned firms while the private, Caixin/Markit survey is better represented with smaller firms. State-owned firms generally benefit from more state support but the divergence in performance favoured the samller firms in October, according to the PMI results at least.

The Japanese election saw the return of the Kishida government, with a reduced, but still workable, majority. There will likely be further economic stimulus programs coming from Japan and with Kishida's majority these will again have no problem gaining parliamentary approval. Japanese stocks gained on the session. Hong Kong and China equities, though, fell.

The US dollar was broadly steady pretty much across the board. There were some gyrations but as I post there is little net change for major currencies against the dollar. Gold added on a few dollars.

How the Japanese election result looks - a comfortable win for PM Kishida: