Forex news for Asia trading Wednesday 12 August 2020

- China's People's Daily - "Taiwan is an inseparable part of the Chinese territory"

- Gold extends it losses under $1900

- NZD drops on the RBNZ policy announcement

- RBNZ leaves cash rate unchanged, boosts asset purchase program

- Heads up for NZD traders - RBNZ monetary policy announcement due at the top of the our

- Australia data - Q2 Wage Price Index +0.2% q/q (expected 0.3%)

- RBA bond buying today, 2bn AUD

- PBOC sets USD/ CNY reference rate for today at 6.9597 (vs. yesterday at 6.9711)

- FX option expiries for Wednesday August 12 at the 10am NY cut

- Global times reports Mexico to conduct trials of potential coronavirus vaccines

- HK press - Chinese military told not to fire first shot in stand-off with US forces

- Australia data - Westpac Consumer Confidence Index (August) -9.5% m/m (prior -6.1%)

- ANZ says the NZD is vulnerable to very dovish RBNZ today

- NZ PM Ardern says there is flexibility to move election date - not needed yet

- NZ PM Ardern says will defer the dissolution of parliament for a few days, no election delay decided as yet

- Australia (state of Victoria) new coronavirus cases today 410

- JPM firmly bullish on EUR/USD - levels to buy more

- Trump says he agreed with Moderna for 100m doses of potential coronavirus vaccine

- Coronavirus - NZ fin min says govt mulling extending wage subsidy measures

- Coronavirus ICYMI - Auckland (New Zealand) is going back into lock down today

- Federal Reserve revises pricing for Municipal Liquidity Facility

- Tesla have announced a five for one stock split

- CME have raised margins on silver, gold contracts

- Jeff Gundlach says he is looking for a lot of short term market reversals

- GBP - UK Chancellor Sunak considering delaying his Autumn budget

- Trade ideas thread - 12 August 2020

- Private oil survey data shows a draw a little more than expected (in crude oil inventory)

Overnight moves continued in Asia today, most notably for precious metals with gold dropping further, under USD1,900, as did silver, under $23.50 at one point. Late US announcement of margin hikes weighed on less well funded traders and contributed to the further declines here in Asia as did Asian flows.

For currencies the main focus was on the Reserve Bank of New Zealand August monetary policy announcement. The Bank announced a larger than expected boost to their asset purchase program (LSAP), to 100bn NZD and issued a dovish statement alongside. We are yet to hear from Governor Orr, his news conference is due at 0300GMT. The NZD was marked lower after the policy decision was issued but has since, as of updating, rebounded to the circa 0.6560s, where it was prior. ICYMI, there has been plenty of news on the new NZ lockdown, the country's largest city of Auckland is back in level 3 restrictions (until at least Friday) while the rest of the country is at L2. NZ has a general election scheduled for September 19 and as yet Prime Minister Ardern has said a delay will not be necessary but speculation is swirling.

While on central banks, the RBA bought 2bn AUD in government securities today as part of its YCC efforts. This is a relatively large purchase by the Bank.

AUD fell a little, as did EUR, GBP, yen, CHF (all against the USD), carrying on lower after their overnight weakness.

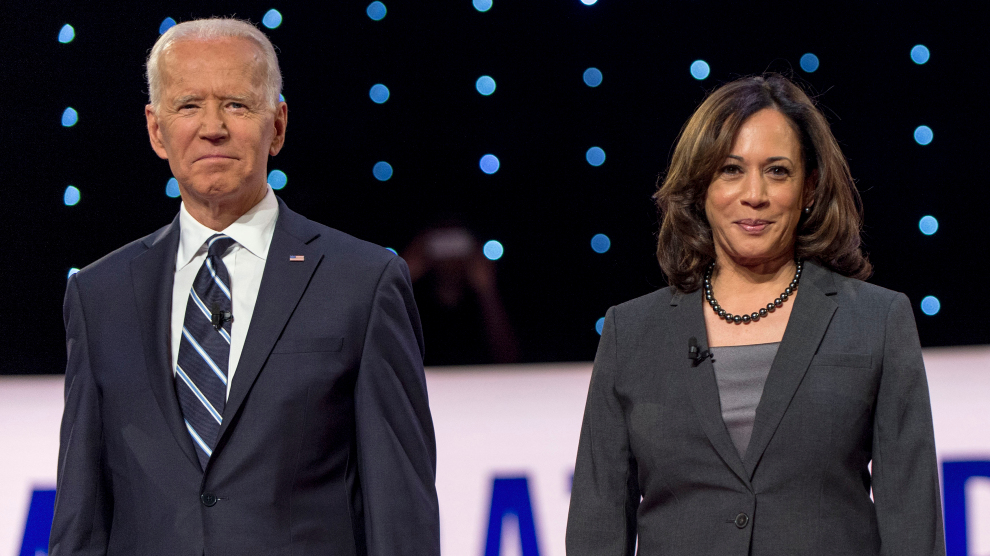

On US stimulus negotiations, there were none. US political news centred on presidential candidate Biden announcing his choice as vice-president running mate California senator Kamala Harris.

What cutesy name will it be … JoKam? KamJo?