Forex news for Asia trading Monday 28 September 2020

- Japan chief cabinet secretary Kato says will not hesitate on additional economic measures if needed

- Chinese authorities have further halted the imports of some frozen food products on virus concerns

- Here is the US election debate timetable (and the bad news)

- China property developer Evergrande - bonds bounce back today after Friday slump

- Australian government forecasting the price of iron ore to remain elevated

- PBOC sets USD/ CNY reference rate for today at 6.8252 (vs. Friday at 6.8121)

- FX option expiries for Monday September 28 at the 10am NY cut

- Yen crosses getting hit

- NZ election - weekend report shows Ardern on track for a comfortable win

- Westpac have cancelled their October RBA rate cut forecast

- Oil trader Vitol says prices have little room to rise in the next quarter because global demand growth is faltering

- Apple is hiring (in China)

- Coronavirus - UK government preparing a total social lockdown across much of northern Britain

- Recap of weekend data - China industrial firm's profits grew for the 4th straight month in August

- Buckle up for Brexit talk day - final round of scheduled talks begin Monday

- ICYMI - There are reports about of a planned terrorist attack on the US embassy in Baghdad

- Australia will continue to underwrite major domestic air routes for the rest of the year

- Trump asked about his tax records - says New York Times report is fake new

- Trump says "of course" there will be a friendly transition - so far no word on his tax returns

- Another ECB member weighs in a warning about EUR - Visco worried by EUR strength - mentions intervention

- Trade ideas thread - Monday 28 September 2020

- US House Speaker Pelosi said another coronavirus stimulus plan is possible

- Ireland's leader says the UK is heading for no deal at Brexit trade talks

- ECB de Cos says no room for complacency on the euro exchange rate

- BoE Tenreyro says the evidence on negative rates is encouraging

- GBP finding an early Monday bid

- War breaks out between Armenia and Azerbaijan

- Monday morning open levels - indicative forex prices - 28 September 2020

- J&J Coronavirus vaccine candidate - induced immune response, showed acceptable safety profile

Very early trade in Asia (pre-Tokyo_ was characterised by GBP volatility in a not large range (1.2740/80 and thereabouts) - bids were propelled by reports of the likelhood of some progress being made on Brexit trade talks (which recommence formally on Monday in Brussels, for the final scheduled round of negotiations) while sellers were encouraged by persistent reports that, no, progress was not being made. As is often the case in Brexit - related headlines there was something for both sides of the market. The optimists have chalked up a victory as I post though, with cable not too far from its session high circa 1.2770.

Other weekend news items showed continuing jawboning of the euro (lower) by ECB members (ps EUR/USD is a little net higher here today) and then late on Sunday the New York Times reported they had gained access to Trump's tax returns showing he had paid little to no tax over the past 15 years. I'd humbly suggest that there is a bigger issue in the NYT piece but before highlighting it would also note that it is not unusual for huge corporations and wealthy people to use tax law to minimise tax payments.

A potentially more interesting issue is the level of personal debt Trump owes, the question is who he owes it to, when it comes due and if it gives lenders leverage over the US President. Anyone who has been subject to a security assessment will understand this - high levels of personal debt are a red flag. I'll leave that to the politics folks to sort through.

The yen has found bids on the day, in a small range, USD/JPY is down to around 105.40 (just under as I post). The USD has weakened elsewhere also, AUD, NZD, GBP all up against it while EUR, CAD are more or less flat against the USD for the session.

There was some stability in trading of China property developer Evergrande after worries cut the legs out of their share and bond prices on Friday - both have bounced today.

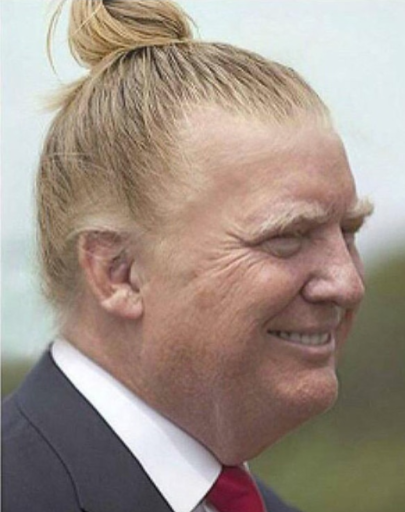

In the NYT piece was Trump claiming USD70,000 for hairstyling expenses. Which seems rather a lot, but professional grooming is certainly a legitimate expense to claim for entertainers. Don't forget pre-president days Trump was a reality TV star.