Forex news for Asian trading on July 30, 2019

- Silver consolidates gains and looks for the next shove higher or lower

- More from the Bank of Japan quarterly report

- Bank of Japan leaves short-term interest rates at -0.1% as per expectations

- IG Markets: Pound seen falling to 1.1800 level as Brexit woes worsen

- EURGBP back above 2016s high at 0.91442

- Australia building approvals for June -1.2% versus 0.2% estimate

- PBOC sets USD/ CNY reference rate for today at 6.8862(vs. Monday at 6.8821 )

- Australia's S&P/ASX200 index trades a new all-time highs

- China PBOC expected to set yuan midpoint at 6.8862 (Reuters estimate)

- Japan industrial production MoM for June (P) -3.6% vs -1.7% estimate

- ANZ Roy Morgan weekly consumer confidence index 118.5 vs 116.3 last

- Japan jobless rate for June 2.3% vs 2.4% estimate

- NZ building permits for June MoM -3.9% vs +13.2% last month

- Mexico's FM Herrera: Announces measures to boost economy

- Lighthizer: US businesses face unfair trade barriers in Vietnam

- Gold is still stuck in an up and down range but buyers are trying again to push higher

In other markets:

- Spot gold is down -$2.19 or -0.15% at $1424.62

- Spot silver is down -2.1 cents or -0.12% at $16.43

- WTI crude oil is up $0.27 or 0.47% at $57.14

From a news standpoint, the Asian session was dominated more by Japan employment which came in mixed with the Unemployment rate dipping to recent multi-year lows at 2.4%,but the job-to applicant ratio also dipping slightly. The impact was limited. Later, industrial production was much weaker than expected at -3.6% vs -1.7% estimate. That helped the USDJPY move a little higher, but the pair ran out of upside steam and started to move back lower into the next key event - the BOJ decision.

No change was expected, but the market expected a softening of the forward guidance a bit. When the statement was released, and the BOJ kept the forward guidance the same, the USDJPY started to move lower. The price went from about 108.80 to a low at 108.62. We currently trade near that level.

Other data came out of New Zealand where building permits slumped -3.9% after rising an oversized 13.2% in May. Needless to say, the data for that series can be volatile and there was little in the way of price action. In fact, through the first 8 or so hours of trading in the new day, the NZD price range is only about 9 pips...yes 9.

In Australian building approvals were also weaker than expected (-1.2% vs 0.2% estimate), but like the NZDUSD, the price reaction was little impacted by the data. The range for the AUDUSD is only 13 pips with ups and downs throughout the session.

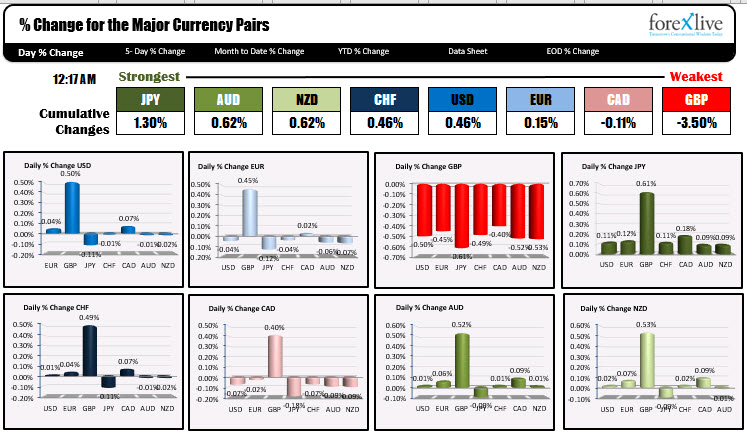

What did move in the session was the GBPUSD (and GBP pairs). Looking at the snapshot of the strongest and weakest pairs (see charts above), all the GBP pairs are lower with declines at the time of the snapshot, of -0.40% (for GBPCAD) to -0.62% (for GBPJPY). The GBPUSD fell -0.50% and the EURGBP saw the GBP decline by -0.45%. Those declines were on top of the sharp declines yesterday where GBP pairs fell -1.13% to -1.49% (we are even lower now as I type).

Although there was nothing in the form of news, there was a pretty easy crack below the 1.2200 level in the GBPUSD (was supposed to be a support leve). That easy break, had traders selling and scrambling. The price has just printed down to 1.2118. That is the lowest level since March 2017 and takes the pair to within 5 pips of a lower trend line (see chart below). Can the level hold as the European/London session approaches? Key level for the pair.