Forex news from the European trading session - 7 August 2018

Headlines:

- Italy's Borghi says need deficit 'a tad higher' to boost demand

- UK to use Trump as secret weapon in Brexit talks?

- UK said to see Brexit deal deadline slipping to end-November - Bloomberg

- China's SAFE says FX reserves will remain stable overall

- China end-July FX reserves $3.118 trillion vs $3.107 trillion expected

- UK July Halifax house price index +1.4% vs +0.2% m/m expected

- Switzerland June foreign currency reserves CHF 749.7 bn vs CHF 748.5 bn prior

- France June trade balance -€6.25 bn vs -€5.52 bn expected

- Italy's Di Maio says government senior officials to meet tomorrow to discuss next budget

- Germany June trade balance €21.8 billion vs €20.9 billion expected

- Germany June industrial production -0.9% vs -0.5% m/m expected

- Japan June preliminary leading indicator index 105.2 vs 105.3 expected

- RBA attempts to mix things up by tweaking inflation outlook

- RBA leaves cash rate unchanged at 1.50%

Markets:

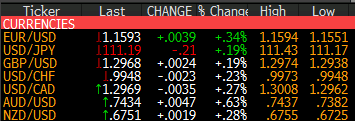

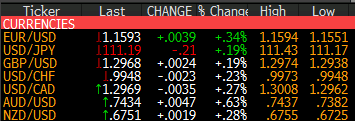

- AUD leads, USD lags behind on the day

- European equities all higher

- Gold up 0.60% to $1,214.70

- WTI up 0.80% to $69.56

- US 10-year yields up 0.6 bps to 2.945%

- Bitcoin up 1.89% to $7,045

The session started with the RBA keeping its cash rate steady for the 22nd straight meeting in two years - an event which produced basically a nil reaction in the aussie. AUD/USD was initially trading around 0.7390 levels and tested 0.7400 before falling back to settle around 0.7395.

The dollar was a little on the back foot ahead of European trading as the greenback was trading sideways against the yuan after the PBOC opted not to fix the yuan lower today - and that allowed for Chinese equities to post a rebound. But a late rally in Chinese stocks during the final hour is what brought life to the session as that resulted in broader risk-on sentiment causing AUD/USD to jump up to 0.7419.

The move also saw the dollar slip against the yuan and in turn against the broader basket of major currencies as well - with EUR/USD moving to a high of 1.1578 eyeing a move towards 1.1600.

The rest of the session played out in similar vein with the dollar clawing back some losses every now and then (nothing notable) but continuously tracking lower as offers mounted. And here we are at the close of the session where the dollar is near the lows against the likes of the aussie, kiwi, euro, and yen.

Looking at individual currencies, EUR/USD started the day in a 20 pips range before the dollar slipped and the pair slowly moved towards 1.1570 levels. Thereafter, buyers continued to bid up the pair eyeing the 1.1600 handle where it is trading near now close to the 100-hour MA.

USD/JPY was one of the more quiet pairs having been trapped within a trading wedge for almost the entire trading day. But sellers are starting to break away now so let's see if the move can be sustained into US trading.

GBP/USD had a less eventful day today as it very much moved in tandem with the dollar's weakness. The pair started the session around 1.2950 and slowly crept higher to reach a high of 1.2974 before settling in the 1.2960 levels.

AUD/USD was the big mover as the pair climbed on the back of improved sentiment in the equities space moving from 0.7390 levels to 0.7420 before extending those gains to 0.7430 levels - just shy of testing last week's high @ 0.7441.

The boost in equities and commodities have also helped the kiwi and loonie who both saw similar trading against the dollar, just with marginally less gains.